ACMD Token Airdrop Calculator

Airdrop Details

This calculator estimates potential ACMD token rewards from the Archimedes Protocol x CoinMarketCap airdrop. Based on a $20,000 pool distributed among winners.

Estimated Rewards

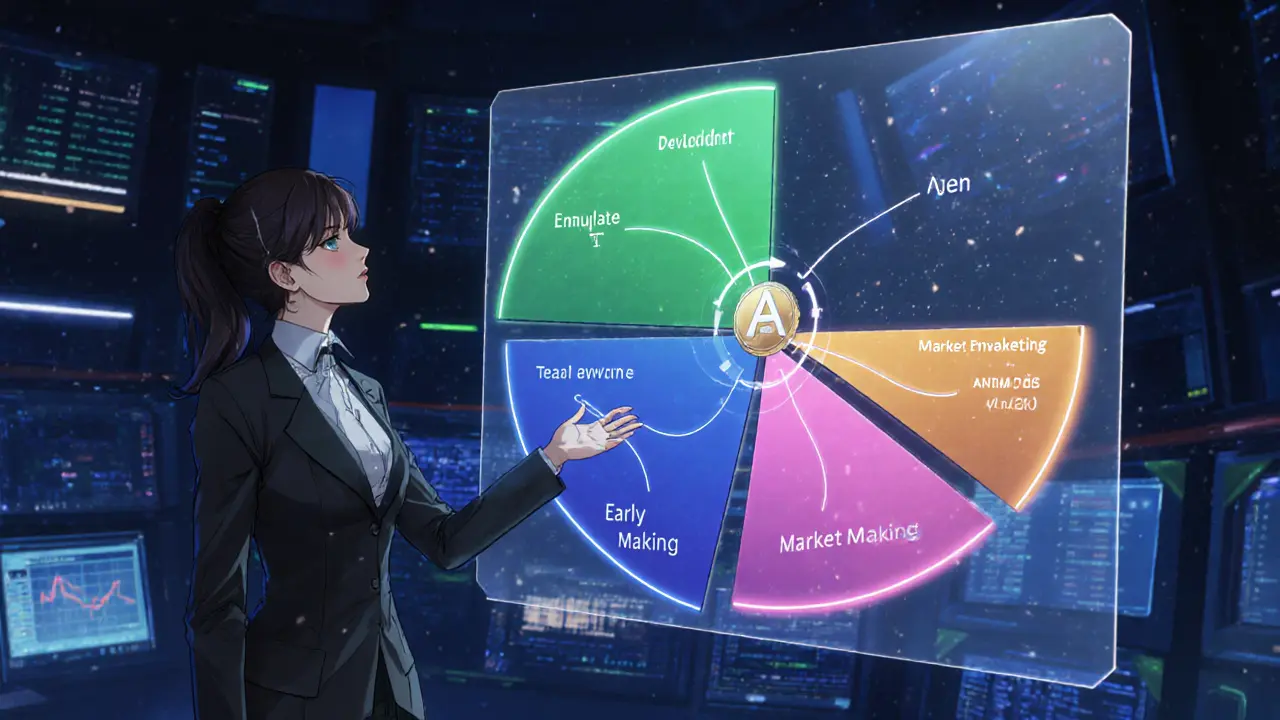

Tokenomics Summary

Total Supply: 1 billion ACMD tokens

Allocation:

- Mining Rewards: 65%

- Team & Development: 15%

- Early Investors: 10%

- Market-Making: 5%

- Marketing & Community: 5%

Important Notes

- This calculator provides estimates only. Actual rewards depend on final winner count.

- Token value is currently uncertain due to market data discrepancies.

- Verify contract address

0x2f8e...1b2a57before any interaction. - Check liquidity pools and exchange listings before trading.

When Archimedes Protocol teamed up with CoinMarketCap for a token giveaway, the crypto community took notice. The ACMD airdrop was positioned as a launch‑boost for the new cross‑chain leverage aggregator, promising a $20,000 pool of native ACMD tokens to early supporters. If you’ve been scrolling through Twitter feeds or Telegram groups and wonder exactly what this event entailed, how to claim the rewards, and whether the token holds any real value, you’re in the right place.

What is the ACMD X CMC airdrop?

ACMD X CMC airdrop is a collaborative token distribution event between Archimedes Protocol and CoinMarketCap (CMC). The campaign allocated roughly $20,000 worth of ACMD tokens to randomly selected participants who completed a set of social‑media tasks. Launched alongside Archimedes’ mining debut on the OKExchain network, the airdrop served as a promotional hook to drive community growth and platform awareness.

The giveaway employed a lottery system: after users submitted their wallet addresses, eligible entries were entered into a random draw. Winners received the tokens directly to the addresses they provided, with no further claim steps required.

How to join the airdrop - step‑by‑step guide

Participation was intentionally simple but required proof of genuine engagement. Follow these steps if you missed the original window and want to replicate the process for future drops:

- Follow the official Archimedes Protocol Twitter account @ArchiProtocol. Retweet the pinned airdrop announcement and tag three friends in the reply.

- Join the public Telegram channel at t.me/ArchimedesGlobal. This ensures you receive real‑time updates and can verify your membership if needed.

- Complete the Google Forms entry (Google Forms link: forms.gle/EcLjf3qjicvqPtZC8). Provide a valid wallet address (ERC‑20 compatible) and confirm you have fulfilled the social tasks.

After submission, the Archimedes team verified each entry, filtered out duplicates, and entered the remaining pool into the random lottery. Winners were announced on both Twitter and Telegram within a week of the cut‑off date.

Tokenomics - how the ACMD supply is allocated

The native token, ACMD, powers the Archimedes ecosystem. Its tokenomics are designed for long‑term sustainability, with a split that mirrors many established DeFi projects.

| Category | Percentage of Total Supply | Release Schedule |

|---|---|---|

| Mining Rewards | 65% | Distributed over 37 months, halving annually after month 1 |

| Team & Development | 15% | Vested over 24 months, aligned with mining milestones |

| Early Investors | 10% | Locked for 12 months, then released linearly |

| Market‑Making | 5% | Allocated to liquidity providers at launch |

| Marketing & Community | 5% | Used for airdrops, partnerships, and brand campaigns |

Two conflicting supply figures appear in public data: CoinMarketCap lists a maximum of 10billion ACMD, while other sources claim a hard cap of 1billion. This discrepancy likely stems from a mis‑aligned token contract version or an undocumented re‑mint mechanism. Investors should verify the contract address (0x2f8e…1b2a57) on a block‑explorer before interacting.

Archimedes Protocol - the platform behind the token

Archimedes Protocol is a cross‑chain leverage aggregator that combines loan mining, leveraged lending, and liquidity mining into a single DeFi suite. Built on the OKExchain, the protocol offers users the ability to open leveraged positions across multiple blockchain networks while earning mining rewards on deposited assets.

Key features include:

- Multi‑chain loan vaults that let users borrow against collateral on one chain and deploy it on another.

- Automated yield‑optimizing algorithms that re‑balance positions to capture the highest APR.

- Integrated market‑making bots that provide liquidity on decentralized exchanges, feeding back into the mining reward pool.

In terms of competition, Archimedes sits alongside established players such as Aave and Compound, but its cross‑chain focus differentiates it from most single‑chain lenders.

Market data - why price information looks odd

Current price feeds for ACMD are contradictory. CoinMarketCap shows a zero USD price with no 24‑hour volume, suggesting either a listing error or a dormant market. Conversely, Crypto.com reports ACMD at roughly $309.60-a staggering difference that hints at either a separate token contract or severe data‑sync issues.

Investors should treat these numbers with caution. Verify the contract address on a reputable explorer (e.g., Etherscan for ERC‑20 tokens) and check liquidity pools on DEX aggregators. If the token is truly untraded on major exchanges, the airdrop’s value may be more symbolic than monetary at this stage.

Risks, red flags, and due‑diligence checklist

Any new DeFi launch carries inherent risk, and the ACMD X CMC airdrop is no exception. Below is a quick checklist before you decide to engage further:

- Contract verification: Ensure the 0x2f8e…1b2a57 address is verified on a block explorer. Unverified contracts can hide malicious code.

- Supply clarity: Confirm whether the token’s total supply is 1billion or 10billion. A ten‑fold discrepancy dramatically affects token scarcity and price potential.

- Liquidity availability: Check if ACMD is listed on decentralized exchanges (e.g., Uniswap, PancakeSwap) and whether there is a sizable liquidity pool.

- Team transparency: Look for developer wallets, GitHub activity, and roadmap updates on the official Medium page.

- Regulatory compliance: Verify that the protocol’s token is not classified as a security in your jurisdiction, especially if you plan to trade or hold long‑term.

By ticking off these items, you’ll reduce the chance of falling into a scam or an ill‑liquid token that never gains traction.

Future outlook - what comes after the airdrop?

Archimedes intends to expand its cross‑chain lending capabilities, targeting integrations with upcoming Layer‑2 solutions and additional blockchain ecosystems. The team also hinted at future partnership token drops, meaning a second wave of giveaways could appear if the first airdrop succeeds in boosting user numbers.

However, the lingering price data mismatch and low trading volume signal that broader market adoption is still in its infancy. Keep an eye on community sentiment in the Telegram group and watch for regular technical updates on Medium. Those who stay engaged early often reap the highest benefits when the platform finally scales.

Frequently Asked Questions

Who was eligible for the ACMD X CMC airdrop?

Anyone who completed the three mandatory tasks-Twitter retweet with tags, joining the Archimedes Telegram channel, and submitting a verified wallet address via the Google Form-was entered into the lottery. There were no geographic restrictions, but participants had to provide a valid ERC‑20 wallet.

How many tokens could a winner expect to receive?

The exact amount per winner was not disclosed publicly. The $20,000 pool was divided among all selected winners, so individual payouts varied based on the total number of recipients.

Is the ACMD token tradable on major exchanges?

As of the latest data, ACMD does not appear on major centralized exchanges. It may be listed on a few decentralized platforms, but liquidity is thin. Traders should verify pool depth before attempting swaps.

What makes Archimedes different from Aave or Compound?

Archimedes focuses on cross‑chain leveraged lending, allowing users to borrow on one chain and deploy assets on another. This multi‑chain capability is not a core feature of Aave or Compound, which operate primarily on single‑chain environments.

Where can I find official updates about future airdrops?

Follow the official Archimedes Twitter @ArchiProtocol, join the Telegram community, and subscribe to their Medium blog. Announcements are typically posted across all three channels simultaneously.

Kate Nicholls

May 3, 2025 AT 01:09 AMAlright, let’s break this down piece by piece. The ACMD‑CMC airdrop is being marketed as a low‑effort way to get free tokens, but the fine print reveals a fairly typical distribution model. First, the total pool of $20,000 is modest when you consider the hype surrounding new DeFi projects. Second, the tokenomics allocate 65% to mining rewards, which essentially means most of the supply is tied up in future mining incentives rather than immediate liquidity. Third, the team and development share of 15% raises the usual red‑flag about how much control the founding team retains. Fourth, early investors claim a solid 10% slice, again a common practice that benefits insiders more than the average participant. Fifth, the market‑making and community allocations are each only 5%, which is insufficient to drive strong price support or robust community engagement. Moreover, the requirement to verify a contract address before any interaction is standard, yet it also signals that the contract could be a target for scams if users aren’t careful. The calculator itself is a nice UI touch, but it merely provides estimates based on assumptions that may never materialise. In practice, the actual number of winners will likely be lower than the theoretical maximum, shrinking each individual payout. Additionally, the note about market data discrepancies hints at volatility that could render the airdrop value negligible by the time the tokens list. Lastly, the lack of clear timelines for token distribution leaves participants in a state of perpetual waiting, which is rarely a good sign. All in all, while the airdrop looks appealing on the surface, the underlying economics and governance structures suggest you should approach it with a healthy dose of skepticism.

Naomi Snelling

May 11, 2025 AT 23:03 PMHonestly, I keep seeing these "official" airdrops pop up and wonder who's really pulling the strings. The entire ecosystem is riddled with hidden agendas, and when they say "verify contract address" it feels like a veiled warning. The pool is so tiny compared to the hype; I bet a few whales are already in on it before anyone else knows. Nothing about this feels truly decentralized, but the story they sell is all about community empowerment. If you’re not looking at the fine print, you’ll get caught in the usual pump‑and‑dump cycle that these projects love. It’s best to stay vigilant and keep your wallets isolated from any unverified contracts. Remember, the people who benefit most from these airdrops are often the same ones who design the tokenomics to favor insiders.

Michael Wilkinson

May 20, 2025 AT 20:56 PMListen up, the ACMD airdrop isn’t a free lunch and the poster should be crystal clear about the risks. The massive mining reward allocation means most of the supply is locked away, making the circulating supply tiny and volatile. The team’s 15% slice is a red flag – they have a lot of power over the token’s future. Also, the lack of a clear distribution schedule makes it impossible to gauge when you’ll actually see any token move. If the project wants credibility, it needs to lay out transparent timelines and show real utility beyond speculation. Until then, treat this with the same skepticism you’d give any unproven DeFi token.

Charles Banks Jr.

May 29, 2025 AT 18:49 PMOh wow, another airdrop that promises big bucks for barely any effort – how original! I mean, sure, $20k sounds nice until you realize it’s split among a potentially massive crowd, making your slice practically dust. And those tokenomics? Yeah, 65% for mining rewards, because nothing says "stable" like having the majority of supply locked away forever. The team’s 15% reserve? Classic move to keep the folks in power comfy while the rest scramble for crumbs. Honestly, if you’re looking for a wild ride, this might be it, but don’t expect any real value to stick around once the hype dies down.

Ben Dwyer

June 7, 2025 AT 16:43 PMHey all, if you decide to jump into the ACMD airdrop, make sure you keep your private keys secure and only interact with the verified contract address. Start by setting a modest expectation – think of this as a learning experience rather than a guaranteed profit. If you’re new to airdrops, use a separate wallet to avoid risking your main holdings. Keep an eye on official channels for any updates on winner counts and distribution dates. Good luck, and stay safe out there.

Lindsay Miller

June 16, 2025 AT 14:36 PMI get why people are excited about a free token drop, but it’s worth thinking about the bigger picture. The allocation numbers show that most of the supply is set aside for mining and the team, which could limit the impact for everyday users. Also, without a clear use‑case, the token might struggle to find value after the airdrop phase. If you’re interested, maybe treat it as a chance to learn more about how tokenomics work, rather than expecting quick gains.

Katrinka Scribner

June 25, 2025 AT 12:29 PMOMG this airdrop looks so cool 😍! I can’t wait to see if I get some ACMD tokens 🙌. Hope the contract address is legit 😅. Fingers crossed!! 😂

VICKIE MALBRUE

July 4, 2025 AT 10:23 AMLooks like a fun opportunity. Keep your expectations realistic and enjoy the process.

Waynne Kilian

July 13, 2025 AT 08:16 AMHey folks, I think we should look at this with open minds – sure the airdrop looks flashy, but the real test will be after launch. If the community can rally and provide real utility, maybe this token could find a niche. At the same time, we shouldn’t ignore those huge allocations to mining and the team – they could steer the direction. Let’s keep the discussion friendly and share any new info we find. After all, collaboration beats competition any day.

Jacob Anderson

July 22, 2025 AT 06:09 AMAnother “ground‑breaking” airdrop that promises riches but delivers dust. The tokenomics read like a cheat sheet for insiders, and the vague winner count is just a trick to keep people hopeful. If you’re looking for genuine value, you’ll have to look far beyond the hype.

Kate Roberge

July 31, 2025 AT 04:03 AMWell, isn’t this just another airdrop trying to ride the wave? Honestly, I’m not convinced the token has any real purpose beyond the initial buzz. The distribution seems designed to favor early insiders, and the community rewards are pretty slim. If you’re hoping for a moonshot, you might be setting yourself up for disappointment.

Oreoluwa Towoju

August 9, 2025 AT 01:56 AMSounds interesting.

Jason Brittin

August 17, 2025 AT 23:49 PMYo, if you’re diving in, just make sure you keep everything in a separate wallet and avoid sharing your seed phrase. Also, stay tuned for any official updates – sometimes they drop extra info about the winner count or new partnerships. Good vibes! 🚀

Amie Wilensky

August 26, 2025 AT 21:43 PMIndeed; the tokenomics, as presented, reveal a pronounced allocation bias toward mining rewards (65 %), which, from a governance perspective, may engender centralization risks; additionally, the team’s 15 % stake suggests a potential for preferential influence over protocol decisions; furthermore, the lack of a transparent timeline for token distribution could exacerbate market speculation; in sum, prospective participants ought to conduct rigorous due diligence prior to engagement.

MD Razu

September 4, 2025 AT 19:36 PMWhen we examine the architecture of this airdrop, several layers of intricacy become apparent. The superficial appeal of a $20,000 pool masks a deeper structural design wherein the majority of tokens are earmarked for mining rewards, a decision that inevitably skews supply dynamics. Moreover, the team’s allocation, while presented as a means to fund development, also constitutes a substantial voting bloc in any future governance frameworks. One must also consider the early investor tranche; this segment is often positioned to reap outsized gains, creating an uneven playing field for average participants. The modest market‑making allocation could be insufficient to sustain liquidity, thereby making the token vulnerable to rapid price declines post‑launch. Additionally, the community portion, though well‑intentioned, remains a mere 5 % of the total supply, limiting its capacity to galvanize widespread adoption. The announcement’s vague language regarding winner count further compounds uncertainty, as the actual number of recipients may be considerably lower than projected, diluting individual rewards. In light of these observations, it is prudent for prospective participants to weigh the potential short‑term gains against the long‑term viability of the token’s economic model. Ultimately, engaging with this airdrop demands a balanced assessment of both its promotional allure and the underlying tokenomics that drive its sustainability.