FairySwap Privacy Features Comparison Tool

FairySwap

Uses Findora blockchain with ZKP technology to hide transaction amounts and counterparties while maintaining public verification.

Uniswap

Full transparency - all transaction details are visible on the blockchain.

SushiSwap

Limited privacy with optional Layer-2 private swaps.

PancakeSwap

No privacy features - all trades are fully public.

With Privacy Shield (FairySwap)

- Amount: Hidden

- From: Hidden

- To: Hidden

- Proof Hash: Validated

Without Privacy Shield (Uniswap)

- Amount: 0.5 ETH

- From: 0x742d...aBcD

- To: 0x890E...EfGh

- Proof Hash: N/A

When you hear the name FairySwap is a privacy‑focused decentralized exchange built on the Findora blockchain, the immediate question is whether the hype lives up to the tech. This review breaks down the platform’s core architecture, its market visibility, how it stacks up against familiar DEXs, and the regulatory headwinds that could shape its future.

What FairySwap Claims to Be

FairySwap positions itself as a next‑generation, community‑driven DEX that lets users decide which transaction details stay public and which stay hidden. The claim rests on zero‑knowledge proof (ZKP) technology, a cryptographic method that proves a statement is true without revealing the underlying data.

Technical Backbone: Findora and Zero‑Knowledge Proofs

The platform runs on Findora is a blockchain designed from the ground up for privacy‑preserving financial applications. Findora integrates ZKPs directly into its consensus layer, allowing zero‑knowledge proof is a cryptographic proof that validates a transaction without exposing amounts, addresses, or other sensitive fields to be used by smart contracts without extra wrappers.

In practice, FairySwap users can select a “shielded” mode for a trade. The transaction is recorded on the public ledger, but the amount and counterparties are hidden. Network validators still verify the proof, ensuring the swap obeys the protocol’s rules.

Privacy Feature in Action

- Connect your wallet (MetaMask, Keplr, or any Findora‑compatible wallet).

- Choose the token pair you want to trade.

- Toggle the privacy shield switch. The UI shows that the amounts will be hidden.

- Confirm the swap. A ZKP is generated and submitted alongside the transaction.

- The blockchain records a proof hash, but observers cannot see the hidden values.

This workflow mirrors typical DEX swaps, with the added privacy toggle as the only major difference.

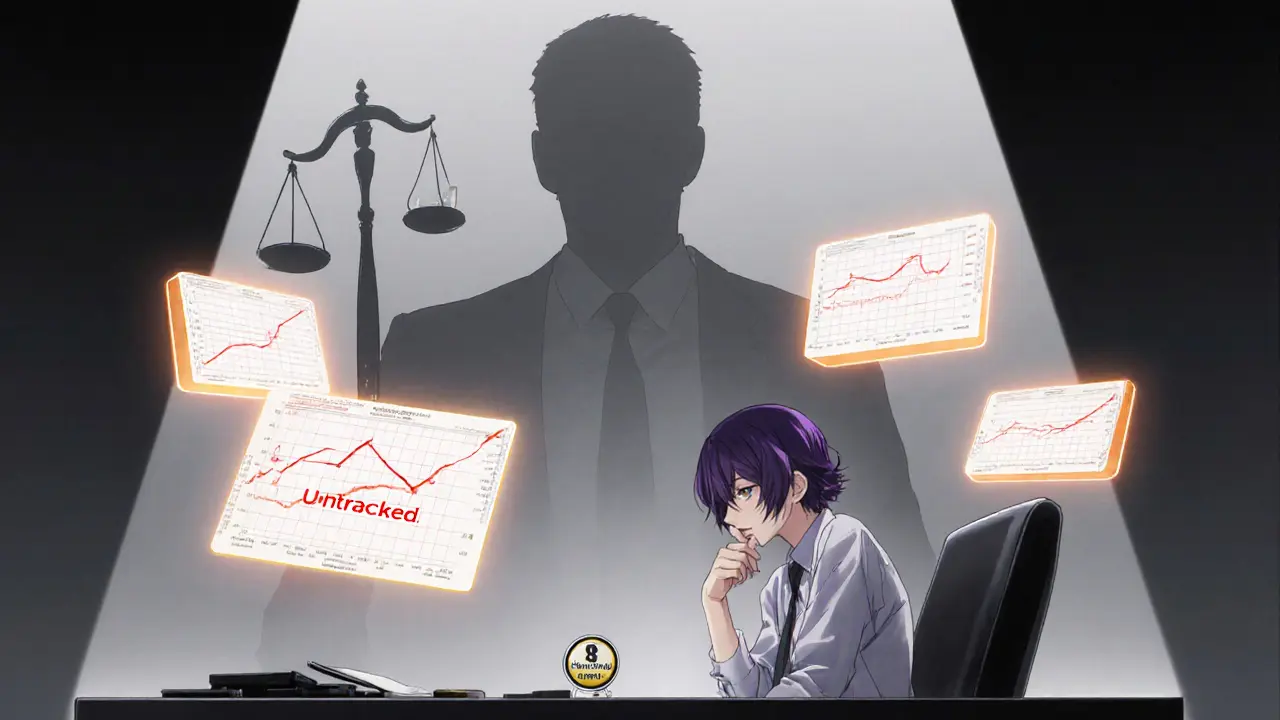

Market Visibility: The “Untracked” Reality

According to CoinMarketCap is a leading cryptocurrency data aggregator that tracks volume, liquidity, and market pairs for exchanges worldwide, FairySwap carries an “Untracked Listing” status. That label means the platform does not meet the minimum volume threshold for automatic tracking, or it lacks a reliable API feed for real‑time data.

The consequences are practical: traders cannot see official volume numbers, order‑book depth, or historical trade charts on mainstream data sites. Without these metrics, gauging liquidity risk becomes a manual exercise-usually by querying the DEX’s own subgraph or exploring on‑chain transaction logs.

How FairySwap Compares to Mainstream DEXs

| Exchange | Core Chain | Privacy Feature | Volume Tracking | Typical Fees* |

|---|---|---|---|---|

| FairySwap | Findora | Zero‑knowledge shield (user‑controlled) | Untracked (CM‑C) | ≈0.30% (estimated) |

| Uniswap is an Ethereum‑based automated market maker DEX | Ethereum | None (full transparency) | Tracked (high volume) | 0.30% |

| SushiSwap is a multi‑chain AMM DEX originally forked from Uniswap | Multi‑chain | Limited (optional private swaps via Layer‑2) | Tracked | 0.25%‑0.30% |

| PancakeSwap is a Binance Smart Chain AMM DEX | BSC | None | Tracked | 0.20% |

*Fees are approximate and can vary with token‑specific incentives.

The table highlights FairySwap’s unique privacy shield but also its lack of visible volume-a double‑edged sword for risk‑averse traders.

Competitive Landscape: Privacy‑Centric Alternatives

Other platforms trying to marry DeFi with privacy include Tornado Cash is a protocol that mixes Ether to obscure transaction history (now under regulatory sanction) and dYdX is a derivatives DEX that offers optional privacy layers for certain markets. Neither offers a full‑stack AMM with on‑chain privacy the way FairySwap claims to, but they illustrate a growing appetite for shielded transactions.

Regulatory Headwinds

Privacy‑enhancing crypto tools sit in a gray zone. Recent actions against Tornado Cash have shown that regulators can target platforms that enable anonymization, labeling them as potential money‑laundering conduits. FairySwap’s reliance on Findora’s ZKP stack means the exchange could face compliance requests to disclose transaction proofs or to implement on‑chain audit trails, which would erode the very privacy it promises.

For users in strict jurisdictions (e.g., the U.S., EU, Singapore), the lack of a clear KYC/AML policy on FairySwap raises red‑flag questions. Until the team publishes a compliance roadmap, institutional investors will likely steer clear.

Risks, Red Flags, and What’s Missing

- Data opacity: No public volume, liquidity, or order‑book depth makes trade execution riskier.

- Team anonymity: There is no verifiable leadership roster, audited codebase, or third‑party security audit publicly linked.

- Dependency on Findora: If Findora’s adoption stalls, FairySwap inherits the same limitation.

- Unclear fee schedule: The website mentions a “standard AMM fee” but does not break down LP rewards or gas costs.

- Regulatory uncertainty: Privacy features could attract enforcement actions, especially if the platform is used for illicit flows.

Who Might Actually Benefit From FairySwap

If you are a privacy‑savvy trader who values on‑chain anonymity over deep liquidity, FairySwap offers a usable shield without leaving the DEX world. Early adopters who can tolerate thin order books and are comfortable monitoring on‑chain metrics manually may find the platform attractive.

Conversely, casual investors, large‑scale traders, or anyone needing regulatory compliance should look at more established DEXs or centralized exchanges that provide transparent reporting.

Quick Checklist Before You Dive In

- Confirm your wallet supports Findora (e.g., Keplr).

- Test a small trade with the privacy shield on to verify proof generation.

- Manually inspect on‑chain transaction hashes via a Findora explorer for liquidity clues.

- Stay updated on any audit reports or compliance statements from the FairySwap team.

- Consider the regulatory stance in your country regarding privacy‑focused crypto tools.

Bottom Line

FairySwap delivers on its core promise: a DEX that lets you hide transaction details using zero‑knowledge proofs. Technically, the integration of Findora and ZKPs is solid, but the platform’s market opacity, missing team transparency, and regulatory gray area heavily restrict its appeal. For niche users who prioritize privacy above everything else, it’s worth a cautious experiment. For the broader crypto community, the lack of data and compliance signals suggest waiting for more robust signals before committing significant capital.

Frequently Asked Questions

What blockchain does FairySwap run on?

FairySwap is built on the Findora blockchain, which emphasizes privacy‑preserving financial applications.

How does the privacy shield work?

When you toggle the shield, the DEX creates a zero‑knowledge proof that validates the swap without revealing the amount or counterparties. Validators confirm the proof, and the transaction is recorded on‑chain with hidden details.

Is FairySwap’s trading volume tracked?

No. CoinMarketCap lists FairySwap as an “Untracked Listing,” meaning there is no public volume or liquidity data available through major aggregators.

Do I need to complete KYC on FairySwap?

FairySwap is designed as a permissionless DEX, so there is no built‑in KYC workflow. However, jurisdiction‑specific regulations may still apply to your activity.

What are the main risks of using FairySwap?

Key risks include lack of visible liquidity, no public audit reports, dependence on the Findora ecosystem, and potential regulatory actions against privacy‑enhancing protocols.

Caleb Shepherd

October 8, 2025 AT 08:22 AMWow, FairySwap really tries to pull the veil over every transaction, huh? They claim zero‑knowledge proofs keep your moves hidden, but have you ever wondered who's actually validating those proofs? If the validators are compromised, the whole privacy illusion could crumble, and we’d all be left exposed. Plus, the Findora chain itself is still a mystery to most regulators, which makes me nervous about any future crackdowns. Still, if you love hiding your swaps like a secret‑agent, it might be worth a cautious peek.

Jason Wuchenich

October 12, 2025 AT 09:35 AMHey folks, if you’re just testing the waters, start with a tiny trade and toggle that privacy shield. It’s a low‑risk way to see the proof generation in action without committing a lot of capital. The UI is pretty straightforward, so you won’t get lost even if you’re new to ZKPs. Remember, even a modest amount can give you a feel for the liquidity and speed. Keep it simple and you’ll get a good sense of whether FairySwap vibes with your strategy.

Darren Belisle

October 16, 2025 AT 10:48 AMHonestly, the concept of on‑chain privacy is absolutely exciting, especially when it’s baked right into the DEX layer, and the ability to hide amounts, counterparties, and still have a verifiable proof is a game‑changer, because it merges DeFi accessibility with the anonymity that many users crave, and while the platform is still untracked, early adopters can benefit from thin order books, which often mean better slippage for small trades, plus the community seems eager to contribute to the ecosystem, so I’m hopeful we’ll see more tooling soon!

Heather Zappella

October 20, 2025 AT 12:02 PMFairySwap operates on the Findora blockchain, which was designed specifically for privacy‑preserving financial applications. The zero‑knowledge proofs are integrated at the consensus level, allowing transactions to be validated without exposing amounts or addresses. However, the lack of publicly available audit reports means users should perform their own due diligence before allocating significant capital. Additionally, the platform’s “Untracked” status on aggregators limits visibility into liquidity and volume metrics. These factors make it essential to monitor on‑chain data directly through a Findora explorer.

Moses Yeo

October 24, 2025 AT 13:15 PMOne could argue that the very secrecy FairySwap touts is a double‑edged sword; on one hand, it safeguards user anonymity, on the other, it creates fertile ground for malicious actors, regulators, and even opportunistic whales to manipulate markets unseen, and while the ZKP technology is mathematically sound, the practical implementation may harbor undisclosed vulnerabilities, thus the platform’s opacity should be approached with a healthy dose of skepticism, especially given recent regulatory actions against similar privacy tools.

Lara Decker

October 26, 2025 AT 19:48 PMThe opacity indeed raises red flags; without transparent volume data, assessing slippage risk becomes a guessing game.

Anna Engel

October 29, 2025 AT 03:22 AMGuess we’ll just have to trust the ghosts on the blockchain.

manika nathaemploy

November 1, 2025 AT 14:42 PMi feel u, it’s kinda scary to jump into a DEX that doesn’t show you the numbers, but if u only wanna try a lil swap just to see how the shield works, go for it, just keep ur eyes open.

Marcus Henderson

November 5, 2025 AT 02:02 AMThe procedural steps for engaging with FairySwap are delineated with clarity: first, ensure compatibility of your digital wallet with the Findora network; second, initiate a trade pair selection within the interface; third, activate the privacy shield toggle to engage zero‑knowledge proof generation; fourth, submit the transaction for validation by network validators; finally, verify the proof hash on the public ledger to confirm successful execution. Adherence to these stages mitigates inadvertent exposure of transactional details.

Caitlin Eliason

November 8, 2025 AT 13:22 PMWhat we are witnessing is not just another crypto platform, but a potential gateway for illicit activity cloaked in mathematical wizardry. If regulators turn a blind eye, society may inadvertently endorse a tool that enables money laundering on a massive scale. This is a ethical crossroads: do we prioritize individual privacy over collective security? The answer will define the future moral fabric of the digital economy.

Ken Pritchard

November 12, 2025 AT 00:42 AMFor anyone feeling uncertain, consider joining community channels where users share their on‑chain findings. Collective knowledge can help you spot liquidity pools, assess transaction latency, and understand fee structures better than any single blog post. Sharing experiences builds a safety net for newcomers.

Brian Lisk

November 15, 2025 AT 12:02 PMFairySwap presents a compelling proposition by integrating zero‑knowledge proofs directly into its AMM architecture, which, on paper, resolves the long‑standing tension between transparency and privacy in decentralized finance. The underlying Findora blockchain was constructed to support confidential transactions, and its consensus mechanism validates proofs without revealing the underlying data, an achievement that aligns with academic research in cryptography. However, the practical implications of such technology extend beyond mere technical elegance; they influence user behavior, market dynamics, and regulatory scrutiny. By obscuring transaction amounts and counterparties, the platform inherently reduces the amount of information that market makers and arbitrage bots can exploit, potentially leading to narrower spreads for participants who value privacy. Conversely, the lack of observable volume data on aggregators like CoinMarketCap impedes the ability of traders to gauge liquidity depth, making it harder to assess price impact before executing sizable swaps. The platform’s “Untracked” status also means that traditional risk metrics, such as order‑book depth charts and historical trade analysis, are unavailable without resorting to on‑chain data extraction. For developers, this necessitates building custom subgraph solutions or employing third‑party indexing services, which adds an operational overhead that may deter casual users. In addition, the economic incentives for liquidity providers on FairySwap remain somewhat opaque; while the website mentions a standard AMM fee of approximately 0.30%, it does not delineate the distribution of fees to LPs, nor does it disclose any native token rewards that could affect yield calculations. Without clear incentive structures, potential LPs must perform their own calculations, increasing the barrier to entry. Moreover, the dependency on Findora’s adoption trajectory adds a layer of network risk: should the Findora ecosystem fail to attract sufficient developer interest, the DEX could suffer from reduced transaction throughput and higher gas costs relative to more established chains. Regulatory considerations further compound the risk profile. Recent enforcement actions against privacy‑focused protocols underscore the possibility that authorities may demand on‑chain disclosures or impose sanctions on platforms that facilitate anonymized transfers. Users residing in jurisdictions with stringent KYC/AML requirements may find themselves inadvertently non‑compliant, exposing themselves to legal repercussions. Overall, while FairySwap’s technical foundation is robust and its privacy features are genuinely innovative, the surrounding ecosystem lacks the transparency, incentive clarity, and regulatory certainty that many traders and investors require. As such, it is best approached as a niche tool for privacy‑conscious users willing to navigate the additional complexities and accept the inherent risks associated with operating in a less‑visible market environment.

Franceska Willis

November 18, 2025 AT 23:22 PMYo, this DEX looks slick but if the liquidity's thin you might get slippaged big time, so test with tiny amounts first, ok?

Jack Stiles

November 22, 2025 AT 10:42 AMHonestly, I tried the privacy toggle and it worked fine, but the transaction speed was a bit slower than Uniswap.

Ritu Srivastava

November 25, 2025 AT 22:02 PMIt’s irresponsible for any platform to hide its metrics from users; transparency is a cornerstone of trustworthy finance.

Liam Wells

November 29, 2025 AT 09:22 AMFrom a theoretical perspective, the incorporation of zero‑knowledge proofs into a decentralized exchange architecture represents a noteworthy advancement in cryptographic applications; however, empirical validation of security guarantees remains pending pending peer‑review.

Kate O'Brien

December 2, 2025 AT 20:42 PMThey’re probably working with shady guys behind the scenes, just saying.

Ricky Xibey

December 6, 2025 AT 08:02 AMLooks cool, will give it a try.

Sal Sam

December 9, 2025 AT 19:22 PMConsidering the protocol's throughput constraints and potential state‑bloat, one must evaluate the impact on gas efficiency and mempool propagation latency before scaling operations.