KYC – Know Your Customer Explained

When dealing with KYC, the process of confirming a client’s identity to satisfy legal and regulatory standards. Also known as Know Your Customer, it forms the backbone of financial security and fraud prevention. AML, Anti‑Money Laundering rules that work hand‑in‑hand with identity checks strengthens the system by flagging suspicious fund flows. identity verification, the technical methods – from document scans to biometric scans – used to prove a person’s real‑world identity is the practical engine that drives KYC. In short, KYC encompasses identity verification, requires AML compliance, and is shaped by regulatory frameworks.

Key Elements of KYC Compliance

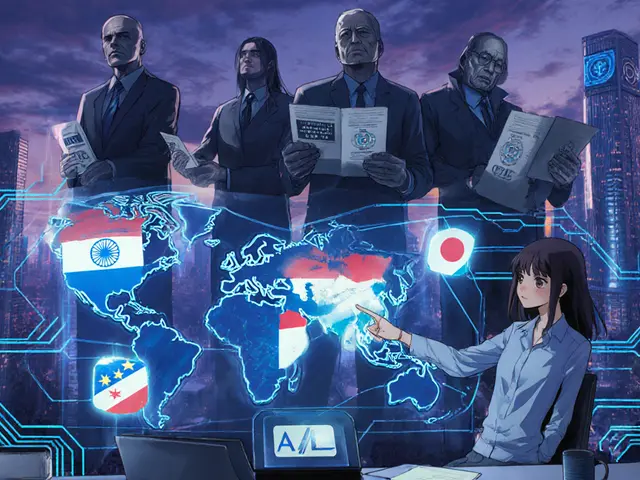

Beyond the basic check, regulators demand beneficial ownership, clear insight into who ultimately controls a legal entity to thwart hidden malicious actors. Different jurisdictions – the US, EU, APAC, Middle East, and Latin America – each impose distinct thresholds, documentation rules, and reporting timelines. This geographic variation means compliance teams must balance global standards with local nuances, often using automated KYC platforms that ingest data, run AML screening, and flag high‑risk profiles. The end result is a smoother onboarding experience for legitimate users while keeping financial crime at bay.

All the pieces above set the stage for the articles you’ll find below. Whether you’re hunting for a 2025 global KYC regulations guide, need a quick rundown of AML updates, or want to see how crypto exchanges apply identity verification, the collection covers practical steps, real‑world examples, and actionable checklists. Dive in to arm yourself with the knowledge you need to stay compliant and keep your crypto activities safe.

How Crypto Exchanges Implement AML Compliance

Learn how crypto exchanges build AML programs, from KYC and transaction monitoring to global regulations and tech stacks, with real‑world examples and a practical checklist.