Escodex Fee Calculator

Calculate Your Savings

Compare Escodex's flat 0.10% trading fee against standard exchanges at 0.25% fee.

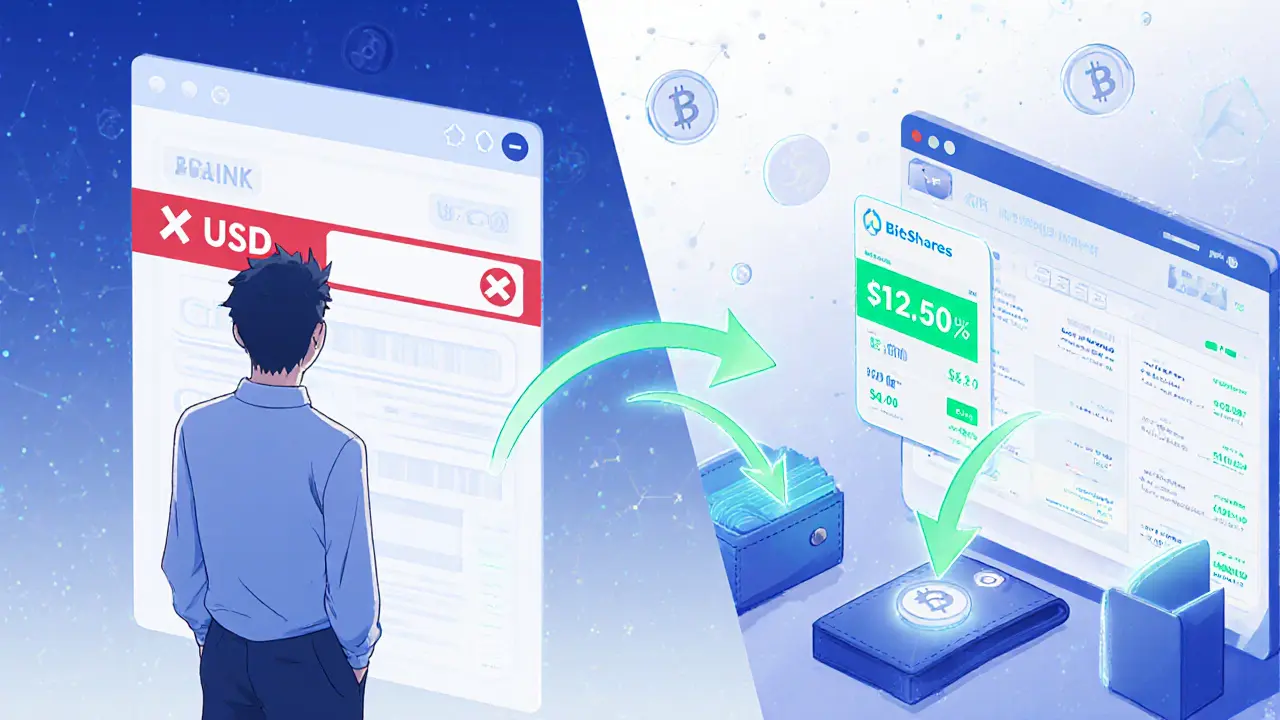

Most crypto exchanges make you pay a lot just to trade. You get hit with 0.25% or more on every buy and sell. Then there’s Escodex - a platform that charges just 0.10% on every trade, no matter how big or small. That’s less than half the industry average. If you’re already holding crypto and trade often, that adds up fast. But here’s the catch: you can’t deposit dollars, euros, or any fiat money. Not even a cent. If you’re new to crypto, Escodex won’t let you in. It’s not a gateway. It’s a highway - and you need to already be on it.

How Escodex’s Fee Structure Works

Escodex doesn’t play by the usual rules. Most exchanges charge different fees for makers (people who add liquidity by placing limit orders) and takers (those who remove liquidity by filling existing orders). Some even charge more if you trade less or if you’re using a credit card. Escodex? Flat 0.10% for everyone. Always. No tiers. No volume discounts because you don’t need them. Whether you trade $100 or $100,000, the fee stays the same.This isn’t just a nice perk - it’s a game-changer for active traders. Say you make 10 trades a week, each worth $5,000. On a standard exchange, you’d pay $12.50 per week in fees. On Escodex? Just $5. That’s $390 saved per year. For someone trading daily, the savings can hit thousands. The math is simple: lower fees mean more profit kept, not paid away.

Withdrawals are even more impressive. Most exchanges charge a flat fee per withdrawal - often $1-$5 for Bitcoin, sometimes more. Escodex doesn’t add its own fee. It only charges the underlying network cost. On BitShares, that’s 0.104 BTS. At current rates, that’s about 0.000014 BTC. Compare that to the industry average Bitcoin withdrawal fee of 0.0008 BTC. Escodex is over 57 times cheaper. That’s not a typo. It’s a feature built into the blockchain it runs on.

Why Escodex Runs on BitShares

Escodex isn’t just another exchange with a fancy website. It’s built directly on the BitShares blockchain. That means it doesn’t use centralized servers to match trades. Instead, it uses decentralized order books powered by Delegated Proof of Stake (DPoS). This isn’t just tech jargon - it affects how fast trades execute, how secure your funds are, and how low fees stay.BitShares was designed from the start to be a decentralized exchange. That’s rare. Most platforms are centralized at their core, even if they say they’re “decentralized.” Escodex inherits BitShares’ real-time settlement, low-latency matching, and native asset issuance. You’re not just trading Bitcoin or Ethereum - you’re trading assets that exist natively on the BitShares chain, like BTS, USD.BTS, or BTC.BTS. These are tokenized versions of real assets, backed by collateral on-chain.

For experienced traders, this means fewer intermediaries, less counterparty risk, and no third-party custody. Your funds aren’t sitting in a wallet controlled by a company. They’re in your own BitShares wallet, and trades happen peer-to-peer on the blockchain. That’s the real value. But it also means you need to understand how to manage your own keys. If you lose your password or private key, there’s no customer service team to recover it. Escodex doesn’t have that option.

The Big Limitation: No Fiat On-Ramps

This is where most people hit a wall. Escodex does not accept bank transfers, credit cards, PayPal, or any government-issued currency. You can’t deposit USD, EUR, AUD, or NZD. If you just bought your first Bitcoin on Coinbase or Binance and want to move it to a cheaper exchange, you’re fine. But if you’re trying to buy your first crypto - forget it.This isn’t a bug. It’s a design choice. Escodex targets one group: crypto-native traders. People who already have wallets, already hold multiple assets, and are looking to minimize trading costs. It’s not for beginners. It’s not for casual investors. It’s for those who treat crypto like a market - not a lottery.

According to Cryptowisser, users who don’t have crypto yet should start with an “entry-level exchange” - platforms like Coinbase, Kraken, or Binance that let you buy with a bank account. Once you’ve got crypto, then move it to Escodex to save on fees. That’s the workflow. Skip it, and you’ll be stuck at the door.

What’s Missing? A Lot

Here’s the hard truth: there’s almost no public data on Escodex. No reviews on Trustpilot. No Reddit threads with real user experiences. No information about the team behind it. No launch date. No trading volume stats. No mobile app. No API for bots. No mention of insurance for user funds. No regulatory disclosures. No security audit reports.That’s not normal. Even lesser-known exchanges publish at least something. Escodex doesn’t. The only reliable source of info is Cryptowisser’s technical breakdown - and even that’s limited. You’re trusting a platform with no public track record. No one can tell you if it’s been hacked. No one can tell you if the team is legitimate. No one can tell you if it will still be around next year.

That doesn’t mean it’s a scam. But it does mean you’re taking a big risk. If you’re trading small amounts - say under $5,000 - and you understand the risks, it might be worth testing. If you’re planning to move $50,000 or more? You’re flying blind. And in crypto, blind faith gets expensive.

Who Is Escodex Really For?

Let’s be clear: this isn’t for everyone. Here’s who it works for:- You already hold multiple cryptocurrencies and trade regularly.

- You’re tired of paying 0.25%+ in fees every time you swap assets.

- You’re comfortable managing your own private keys and using a decentralized wallet.

- You don’t need fiat deposits or withdrawals.

- You prioritize low fees over flashy features or customer support.

Here’s who should avoid it:

- You’re new to crypto and need to buy your first Bitcoin or Ethereum.

- You want to trade using a mobile app.

- You expect 24/7 live chat support.

- You’re not comfortable with decentralized systems.

- You want to know who’s running the platform.

If you fit the first group, Escodex could be one of the most cost-effective tools in your toolkit. If you fit the second? Look elsewhere. There are dozens of exchanges that handle fiat, offer apps, and have real support teams. Escodex isn’t one of them.

Alternatives to Consider

If Escodex feels too risky or too limited, here are three solid alternatives:- Bitfinex: Offers low fees (0.1% maker, 0.2% taker), fiat support, and a strong track record. Not as cheap as Escodex, but more reliable.

- KuCoin: 0.1% trading fee, supports over 700 coins, has a mobile app, and offers fiat on-ramps via third parties.

- Gate.io: 0.1% spot fee, strong security, and a user-friendly interface. Also supports fiat deposits via bank transfer.

None of these match Escodex’s ultra-low withdrawal fees. But they give you something Escodex doesn’t: trust, support, and access to fiat.

Final Verdict: A Tool, Not a Solution

Escodex isn’t a crypto exchange you join because you’re looking for a safe place to start. It’s a tool you use after you’ve already built your portfolio. It’s the equivalent of a race car - fast, efficient, and built for experts. But you don’t buy a race car to drive to the grocery store.If you’re an active trader with crypto already in hand, and you’re sick of losing money to fees, Escodex is worth testing. Start small. Move $500. See how the interface works. Try a few trades. Learn how the BitShares wallet connects. Then decide.

If you’re still trying to figure out how to buy your first Bitcoin? Walk away. Use a platform that lets you deposit fiat. Once you’ve got your crypto, then come back.

Escodex doesn’t try to be everything. And that’s its strength. But it’s also its weakness. It doesn’t cater to newcomers. It doesn’t offer support. It doesn’t promise safety. It just offers cheap trades. And for some, that’s enough.

Can I deposit USD or EUR on Escodex?

No, Escodex does not accept any fiat currency deposits. You cannot deposit USD, EUR, AUD, NZD, or any government-issued money. You must already own cryptocurrency to trade on this platform.

What are the trading fees on Escodex?

Escodex charges a flat 0.10% fee on every trade, whether you’re a maker or a taker. This is significantly lower than the industry average of around 0.25%. There are no volume discounts or tiered pricing - the fee is the same for everyone.

Are withdrawal fees high on Escodex?

No, withdrawal fees are extremely low. Escodex only charges the native network fee on the BitShares blockchain: 0.104 BTS (roughly 0.000014 BTC). This is over 50 times cheaper than the average Bitcoin withdrawal fee on other exchanges, which is typically around 0.0008 BTC.

Is Escodex safe to use?

There is no public information about security audits, insurance for user funds, or the team behind Escodex. The platform runs on the BitShares blockchain, which is decentralized, but there are no verified reports on past security incidents or operational reliability. Use only small amounts until you fully understand the risks.

Does Escodex have a mobile app?

No, Escodex does not offer a mobile application. The platform is accessible only via web browser, and there is no official app for iOS or Android.

Who is Escodex best suited for?

Escodex is best for experienced crypto traders who already hold digital assets and want to minimize trading and withdrawal fees. It’s not suitable for beginners, casual investors, or anyone needing fiat on-ramps or customer support.

How does Escodex compare to Binance or Coinbase?

Binance and Coinbase support fiat deposits, have mobile apps, offer customer support, and are regulated in multiple regions. Escodex does none of that. But it charges lower fees and doesn’t hold your funds - you control your wallet. It’s a trade-off: convenience vs. cost and control.

If you’re ready to cut trading costs and you’ve already got crypto, Escodex could save you real money. But if you’re still figuring out how to get started? Start elsewhere. Then come back.

alex piner

November 15, 2025 AT 17:45 PMbro i just moved my eth over from binance and holy crap the fees are insane on there compared to this. saved like 12 bucks on two trades already. 0.10% is a game changer if you trade even a little.

Gavin Jones

November 16, 2025 AT 19:11 PMWhile I appreciate the technical elegance of Escodex’s architecture, I must express concern regarding the absence of regulatory oversight and public transparency. One cannot reasonably entrust capital to an entity whose team remains anonymous and whose security posture is undocumented. Prudence, in such matters, is not merely advisable-it is imperative.

Mauricio Picirillo

November 17, 2025 AT 16:26 PMif you’re new to crypto, don’t even think about this place. i started on coinbase, got my feet wet, then moved my stuff here. the fee savings are real, but you gotta know your keys. no one’s gonna help you if you lose em. just don’t be lazy and think this is like robinhood.

Liz Watson

November 18, 2025 AT 07:11 AMoh wow, a crypto exchange that doesn’t pander to beginners? radical. i thought we were past the ‘let’s make everything dumb enough for grandma to use’ era. maybe this is what innovation looks like when you stop trying to be a bank.

Rachel Anderson

November 19, 2025 AT 13:28 PMIT’S LIKE A SILENT CRYPTIC MASTERPIECE-NO REVIEWS, NO TEAM, NO APP… JUST PURE, UNADULTERATED TRADING ENERGY. I’M CRYING. I’M SCARED. I’M IN LOVE. THIS IS WHAT THE FUTURE LOOKS LIKE WHEN IT DOESN’T CARE IF YOU UNDERSTAND IT.

Hamish Britton

November 21, 2025 AT 02:35 AMi’ve been using it for 6 months now. never had an issue. no drama, no support tickets, no drama. just clean trades and tiny fees. if you’re comfortable with wallets and don’t need hand-holding, it’s solid. the lack of a mobile app? honestly, i prefer the web version. less temptation to trade on impulse.

Robert Astel

November 22, 2025 AT 19:02 PMyou know what’s funny? people are freaking out about no fiat but they don’t realize that crypto was meant to bypass banks entirely. like, why would you want to tie your digital assets to a system that prints money out of thin air and then charges you 3% to move it? escodex is just the next step in evolution. sure, you might lose your keys, but isn’t that just a metaphor for letting go of control? the blockchain doesn’t care if you cry. it just executes. and that’s beautiful.

Andrew Parker

November 23, 2025 AT 03:10 AMi just lost my entire portfolio because i forgot my password… and now i’m sitting here wondering if life has any meaning. i used to think crypto was freedom… now i know it’s just a mirror that reflects your worst fears. 😭

Katherine Wagner

November 24, 2025 AT 19:32 PMno fiat? good. no app? better. no reviews? perfect. no insurance? ideal. this is the only exchange that doesn’t lie to you.

ratheesh chandran

November 26, 2025 AT 12:43 PMbro i try to login and it say 'server error' and i think scam but then i refresh and its work again. maybe its just slow because its decentralized? or maybe its ghost town? i dont know but i keep trying. crypto is pain but also magic.

Hannah Kleyn

November 26, 2025 AT 17:41 PMi’ve been watching escodex for a while. i don’t trade much, but i’m fascinated by how it strips away everything-no marketing, no fluff, no customer service. just pure market mechanics. it’s like a minimalist art piece. you either get it or you don’t. i’m still not sure if i trust it, but i respect it. maybe that’s enough for now.

gary buena

November 26, 2025 AT 22:32 PMlol at people saying 'no security audit' like that’s a bad thing. if you need a third party to tell you it’s safe, you shouldn’t be in crypto. the blockchain is the audit. your keys are the security. escodex just lets you do the work. it’s not broken, it’s just not babysitting you.

Vanshika Bahiya

November 27, 2025 AT 18:06 PMif you're new, start with binance or coinbase. get your first btc, learn how wallets work, then move your funds here. i did this exact thing. saved me over $500 in fees last year. and yes, you can use metamask to connect to escodex-it's not as scary as it sounds. just take it slow and read the docs. you got this 💪

Kelly McSwiggan

November 27, 2025 AT 21:34 PM0.10%? cute. but where’s the liquidity? i tried to swap 10k worth of ltc and the slippage was 3%. the 'low fees' are meaningless if you can’t execute trades without eating your profits. this isn’t a platform-it’s a trap for the naive.

Byron Kelleher

November 28, 2025 AT 09:07 AMyou know what i love? when people act like crypto should be easy. nah. it’s supposed to be hard. escodex doesn’t dumb it down. it just gives you the tools and says 'go be smart'. that’s why i’m here. not because it’s safe-but because it’s real.

Cherbey Gift

November 28, 2025 AT 17:04 PMyo this exchange be like a ninja-silent, deadly efficient, no fancy lights, no crowd, just pure speed and low cost. you don’t need to know who built it. you just need to know it works. and it works like butter on a hot pancake 🍳🔥

Anthony Forsythe

November 29, 2025 AT 22:40 PMthe silence of escodex… it’s not absence-it’s presence. the blockchain speaks louder than any press release. the fees whisper salvation. the lack of a mobile app? that’s not a flaw-it’s a meditation. you sit. you think. you trade. no notifications. no dopamine. just you, your keys, and the immutable ledger. this isn’t finance. this is enlightenment.

Kandice Dondona

November 30, 2025 AT 10:07 AMi tried it last week and it felt like a secret club 🤫✨ i moved $300, traded 4 times, withdrew with 0.000014 btc fee… and i cried happy tears. if you’re ready to grow up in crypto, this is your next step. 🚀❤️