When it comes to cryptocurrency in the United States, there’s no single rulebook. What’s allowed in California might get you fined in New York. And what’s legal in Texas could be a gray zone in Florida. As of 2026, crypto businesses and users are stuck navigating a patchwork of 50 different systems - each with its own rules, penalties, and loopholes. The federal government is finally stepping in with new laws, but until those fully take effect, state-by-state crypto regulations are what really decide whether you can operate, invest, or even hold digital assets without risking a legal headache.

New York: The Strictest State in the Country

New York doesn’t just regulate crypto - it controls it. Since 2015, the state has required every crypto business operating within its borders to get a BitLicense a regulatory license issued by the New York Department of Financial Services (NYDFS) for businesses dealing in virtual currencies. This isn’t just a formality. To get one, companies must submit detailed business plans, prove they have $5 million in net capital, pass background checks on every executive, and submit to quarterly audits. The process can take over a year. Many startups have walked away because of it.

The BitLicense covers everything: buying, selling, storing, and transmitting digital assets. Even peer-to-peer apps that let users send Bitcoin must register if they have any New York users. In 2024, the NYDFS fined Kraken $30 million for failing to properly verify users and for allowing trades that violated anti-money laundering rules. Coinbase paid $50 million in 2023 for similar violations. These aren’t rare cases - they’re routine.

For users, the impact is real. If you live in New York and want to trade lesser-known tokens like Solana or Polygon, you might find them missing from your exchange app. That’s because many platforms simply won’t risk the licensing burden. New York’s rules have effectively blocked dozens of smaller crypto projects from reaching its 20 million residents.

California: Innovation with Guardrails

California does the opposite. Instead of shutting doors, it opens them - with conditions. The state’s Department of Financial Protection and Innovation (DFPI) California’s regulatory body overseeing financial services, including digital assets, with a focus on consumer protection and innovation doesn’t require a special crypto license. Instead, it uses existing money transmitter laws to oversee crypto firms. But here’s the twist: the DFPI has issued clear guidance that says if a company isn’t holding customer funds or acting as a custodian, it doesn’t need a license at all.

This has made California a magnet for crypto startups. In 2025 alone, over 120 new blockchain companies registered in San Francisco and Los Angeles. The state even created a Crypto Innovation Sandbox A regulatory program in California allowing startups to test new crypto products under limited supervision without full licensing, where firms can test new DeFi protocols, NFT marketplaces, or wallet apps under a 12-month probationary period. If they pass, they get a streamlined path to full compliance.

But don’t think California is lax. The state’s attorney general has filed over 30 enforcement actions since 2023 against fraudulent crypto schemes - especially Ponzi-like staking platforms and fake mining operations. So while innovation is welcome, scams aren’t. The message is simple: Build something real, and we’ll help you grow. Rip people off, and we’ll shut you down.

Texas and Florida: The Pro-Crypto States

Texas and Florida have become the most aggressive pro-crypto states in the U.S. Both passed laws in 2024 that explicitly ban local governments from restricting crypto use. In Texas, Governor Greg Abbott signed House Bill 4177, which says no city or county can require crypto businesses to get additional permits beyond state-level ones. Florida followed with Senate Bill 2688, which prohibits any public agency from refusing to accept crypto payments for taxes, fees, or fines.

These laws aren’t just symbolic. In 2025, Houston became the first major U.S. city to allow residents to pay property taxes in Bitcoin. Miami launched a crypto payroll pilot for city workers - 8% of employees now receive part of their salary in Ethereum. Florida’s state pension fund even began allocating 1% of its assets to Bitcoin and Ethereum in late 2025, citing long-term diversification.

Neither state requires a special crypto license. Instead, they rely on federal rules and treat crypto like any other financial asset. If you’re a business owner in Dallas or Orlando, you can accept Bitcoin for goods, run a crypto ATM, or even mine Bitcoin in your warehouse without asking permission. The only requirement? Follow federal anti-money laundering rules. That’s it.

The Midwest and Southeast: Waiting for Clarity

Most states fall into a third category: they haven’t passed any crypto-specific laws at all. In states like Ohio, Georgia, North Carolina, and Illinois, crypto businesses operate under general financial services laws. That means they’re treated like money transmitters, payment processors, or investment advisors - depending on what they do.

For example, in Ohio, a company that lets users buy Bitcoin through an app must register as a money transmitter under the state’s Division of Financial Institutions. But if that same company only provides a wallet that doesn’t hold keys, it doesn’t need to register. The line is thin, and enforcement is inconsistent.

Some states are starting to act. In 2025, Tennessee passed a bill allowing state-chartered banks to offer crypto custody services. Missouri created a task force to study how to attract crypto mining operations. But these are isolated moves. Without clear laws, businesses in these states operate in the dark. Many just avoid operating altogether.

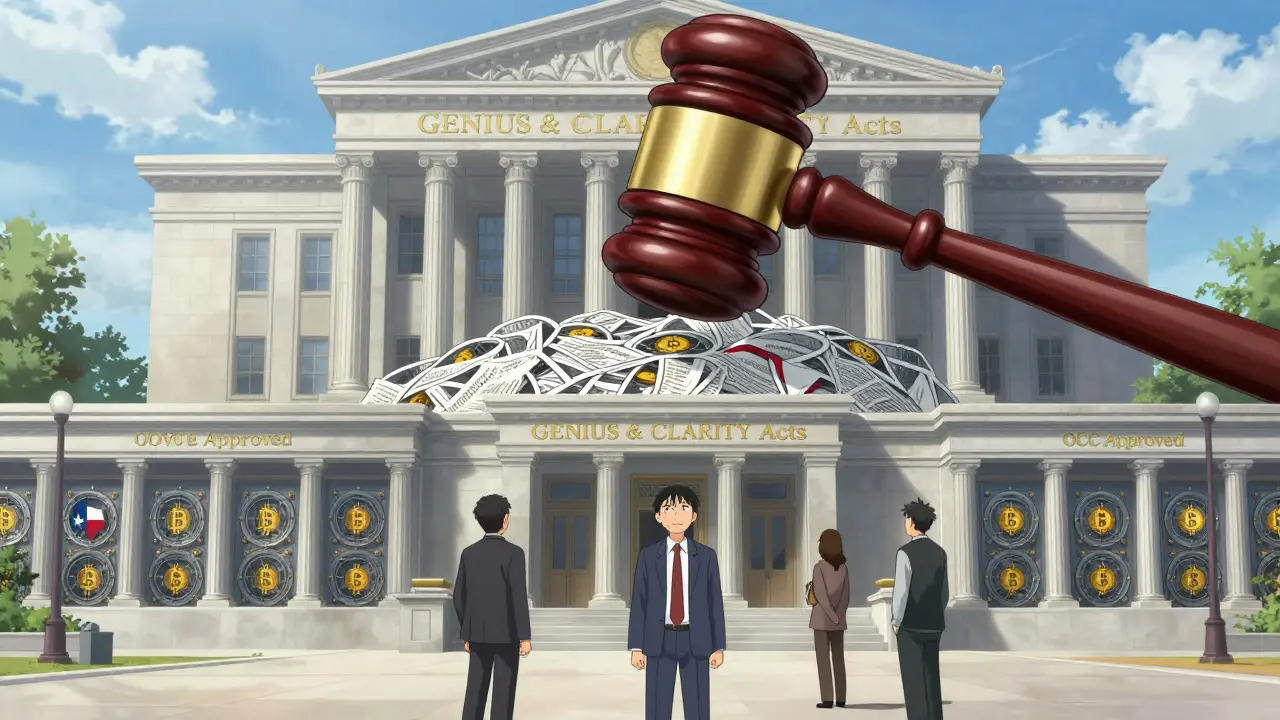

Federal Changes Are Coming - But Not Fast Enough

While states scramble to catch up, Washington is finally moving. In early 2025, President Trump signed the GENIUS Act A federal law enacted in 2025 that establishes clear rules for stablecoin issuers, including reserve requirements and audit obligations, which requires all stablecoin issuers to hold 100% backing in cash or short-term Treasuries and submit quarterly audits. This ended the wild west of algorithmic stablecoins like TerraUSD.

Then came the CLARITY Act A proposed federal law that would shift crypto oversight from the SEC to the CFTC and define clear rules for exchanges and brokers, which is now in the Senate. If passed, it would give the Commodity Futures Trading Commission (CFTC) U.S. federal agency responsible for regulating derivatives markets, including futures and options on digital assets primary authority over crypto - ending the messy tug-of-war between the SEC and CFTC. The SEC would only step in if a token clearly qualifies as a security, like a stock.

On March 7, 2025, the Office of the Comptroller of the Currency (OCC) Federal agency that supervises national banks and federal savings associations, including their crypto activities removed barriers for banks. It now allows national banks to custody crypto, issue stablecoins, and participate in blockchain networks without needing prior approval. This alone has led to over 40 banks - including Wells Fargo and PNC - launching crypto custody services in the last six months.

But here’s the catch: these federal laws don’t override state rules. A bank in Texas can custody Bitcoin today. But if it tries to offer crypto trading to customers in New York, it still needs a BitLicense. The federal rules are setting the floor - not the ceiling.

What This Means for You

If you’re a user: Where you live determines what you can do. If you’re in New York, you’re locked out of many tokens. In California, you can experiment with DeFi and NFTs safely. In Texas or Florida, you can use crypto like cash. If you’re in Kansas, you’re probably stuck with whatever your exchange lets you access.

If you’re a business: You can’t assume one state’s rules apply everywhere. A crypto exchange that only follows federal law will still get shut down in New York. The only way to operate nationwide is to build a compliance system that adapts to each state - which means hiring lawyers, tracking changes monthly, and spending thousands on legal fees.

The good news? The federal government is finally giving the industry clear rules. The bad news? Those rules won’t fix the state mess. Until then, the U.S. crypto landscape remains a legal maze - and the only way out is knowing exactly where you are.

Is Bitcoin legal in all 50 states?

Yes, owning and using Bitcoin is legal in every state. But how you use it isn’t. Some states restrict businesses from accepting it, others require licenses to trade it, and a few (like New York) limit which tokens you can buy. So while you can legally hold Bitcoin anywhere, what you can do with it depends on where you live.

Can I mine Bitcoin in my basement in New York?

Yes. Mining Bitcoin for personal use - even at scale - doesn’t require a license in New York or any other state. The BitLicense only applies to businesses that sell, trade, or custody crypto for others. If you’re mining and keeping the coins yourself, you’re not breaking any law. However, if you start selling the mined Bitcoin to others regularly, you may need to register as a money transmitter.

Which states have the easiest crypto rules?

Texas, Florida, Wyoming, and Ohio have the most business-friendly rules. Wyoming doesn’t require any state-level crypto license. Texas and Florida ban local restrictions and allow crypto payments for taxes. Ohio lets banks offer crypto custody without special approval. These states treat crypto like any other financial tool - not a threat.

Do I need to report crypto on my state taxes?

Yes. Every state that has an income tax - which is 42 of them - requires you to report crypto gains. California, New York, and Washington treat crypto like stocks: you pay capital gains tax when you sell. Some states, like Texas and Florida, don’t have state income tax, so you don’t owe anything extra. But you still must report federal gains. Always check your state’s revenue department website for guidance.

Why does New York have such strict rules?

New York’s regulators were among the first to see crypto as a potential tool for money laundering and fraud. The BitLicense was created after the collapse of Mt. Gox and the rise of unregulated exchanges. The state wanted to protect consumers from scams and ensure financial stability. While it’s been criticized as overly restrictive, it’s also led to fewer high-profile crypto failures within the state than in other places.

What happens if I move from New York to Texas with crypto?

Moving doesn’t erase your past compliance obligations. If you ran a crypto business in New York and got a BitLicense, you still need to maintain it - even if you relocate. But if you’re just a user holding Bitcoin, you can move freely. Your wallet stays yours. The only change? You’ll gain access to more tokens, services, and payment options in Texas. No need to sell or transfer anything.

Elizabeth Choe

February 12, 2026 AT 23:34 PMY’all ever just wanna scream at your screen when you’re trying to buy Shiba Inu and it’s ‘not available in New York’? Like, I get it-fraud happens-but this is 2026, not 2012. I moved from NYC to Austin last year and suddenly my wallet’s got more coins than my fridge has veggies. The freedom? Unreal. 🌟

Grace Mugambi

February 13, 2026 AT 15:08 PMIt’s fascinating how state-by-state regulation mirrors our cultural DNA-New York’s caution, Texas’s ‘do it yourself’ ethos, California’s innovation-with-strings-attached. Maybe the real question isn’t ‘what’s legal?’ but ‘what kind of society do we want crypto to reflect?’

Crystal McCoun

February 14, 2026 AT 04:52 AMJust to clarify: mining Bitcoin in your basement? Totally fine. Selling mined BTC regularly? That’s a money transmitter activity. Registering as a money transmitter? Depends on your state. New York? BitLicense. Texas? No extra step. California? Maybe, if you’re custodial. Ohio? Only if you hold funds. The nuance is exhausting-but necessary.

Elijah Young

February 15, 2026 AT 00:03 AMMost of this is common sense. If you’re running a business, you follow the rules. If you’re just holding coins, you’re fine. The real problem? Companies that treat compliance like a suggestion. That’s not state laws’ fault-that’s corporate laziness.

Donna Patters

February 16, 2026 AT 21:20 PMHow quaint. We allow citizens to gamble with digital tokens while ignoring centuries of economic prudence. New York’s BitLicense isn’t overreach-it’s the last line of defense against financial anarchy. The rest of the country is playing with matches while the adults are still trying to put out the fire.

Michelle Cochran

February 17, 2026 AT 15:40 PMPeople don’t understand that crypto isn’t ‘money’-it’s a cult. And cults need structure. Texas and Florida are just letting people worship at the altar of volatility without any priestly oversight. That’s not freedom-it’s spiritual negligence.

Claire Sannen

February 19, 2026 AT 15:27 PMThe federal laws are a step forward, but they’re not a solution. They’re a floor. The real challenge is harmonizing 50 different systems without creating a bureaucratic monster. I’ve seen this play out in financial services before-consistency rarely wins over local autonomy.

Ben Pintilie

February 20, 2026 AT 13:31 PMlol why is this even a thing. just let people use crypto. if you’re dumb enough to get scammed, maybe don’t invest? 🤷♂️

Sakshi Arora

February 21, 2026 AT 04:49 AMso texas lets you pay taxes in btc? that’s wild. i tried to buy a coffee with doge in seattle and the barista looked at me like i asked for a unicorn latte 😅

Christopher Wardle

February 21, 2026 AT 09:08 AMRegulation isn’t the enemy of innovation-it’s its scaffolding. Without it, crypto remains a carnival. With it, it can become a cathedral. The question is whether we’re building a structure for the people-or a monument to speculation.

Beth Trittschuh

February 21, 2026 AT 11:51 AMCalifornia’s sandbox is genius. Let people build. Let them fail. Let them learn. Then help them rise. That’s how innovation actually works-not by locking doors, but by handing out tools and saying ‘don’t burn the house down.’ 🌱

monique mannino

February 22, 2026 AT 16:31 PMMy mom in Georgia just asked me if she can use crypto to pay her property tax. I laughed. Then I checked. She can’t. But in Florida? She could. That’s the absurdity of this patchwork. It’s not about safety-it’s about geography. 😔