Suterusu (SUTER) Token Calculator

SUTER Token Information

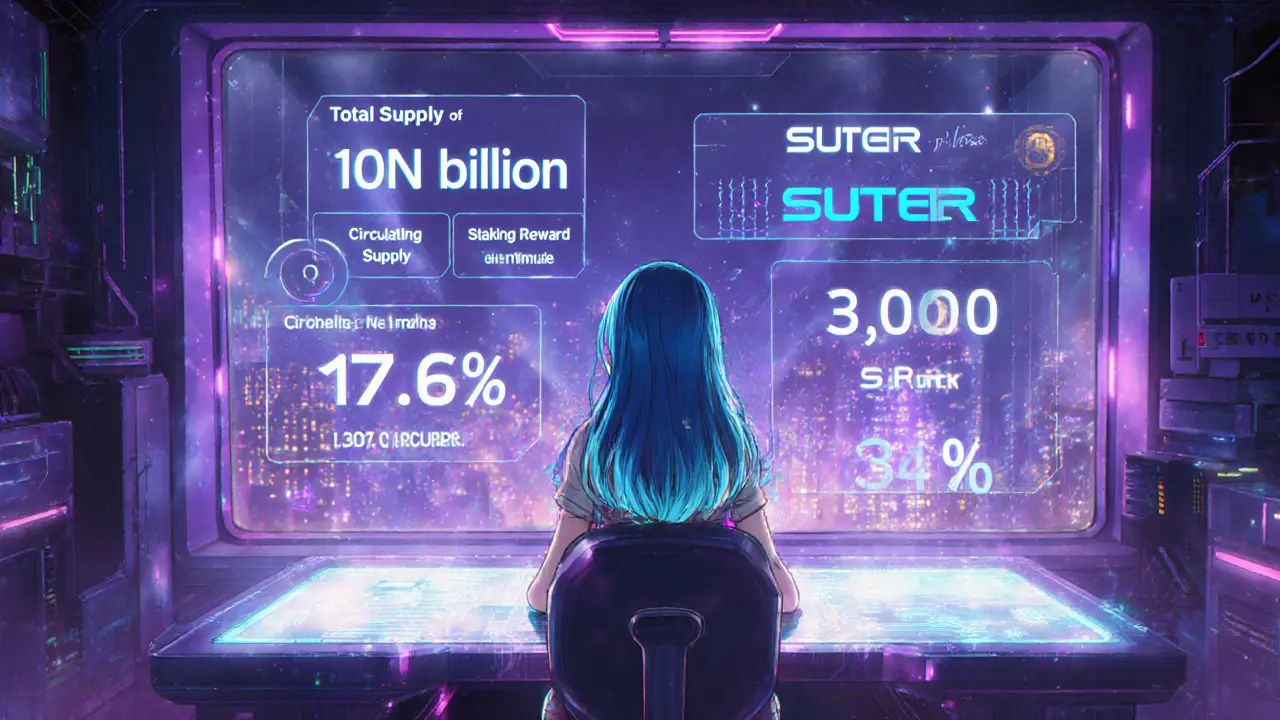

Total Supply:

10,000,000,000 SUTER

Circulating Supply:

~3.76 Billion SUTER

Staking Reward Rate:

3,000 SUTER/min

Annual Inflation:

~4.32 Million SUTER/day

Current circulating supply represents approximately 37.6% of total supply.

Staking Rewards Calculator

Estimated Rewards

Staking Amount:

0 SUTER

Staking Period:

0 days

Daily Rewards:

0 SUTER

Total Rewards:

0 SUTER

Suterusu vs Privacy Coins Comparison

| Feature | Suterusu (SUTER) | Monero (XMR) | Zcash (ZEC) |

|---|---|---|---|

| Privacy Tech | zk-SNARKs layer-2 | Ring signatures & confidential TX | zk-SNARKs (on-chain) |

| Chain | Ethereum-compatible (EVM) | Own PoW/PoS chain | Own PoW chain (Zcash) |

| Governance Token | SUTER (ERC-20) | None (XMR is native) | ZEC (native) |

| Market Cap (Oct 2025) | ≈ $170K | ≈ $5B | ≈ $250M |

| Liquidity | Very low | High | Medium |

Suterusu's unique value proposition lies in its layer-2 privacy model that works on top of existing EVM chains, unlike Monero and Zcash which operate independent blockchains.

Key Takeaways

- Suterusu is a privacy‑first blockchain built on zk‑SNARKs and runs a PoS network.

- The native SUTER token is an ERC‑20 governance and utility token with a fixed 10billion supply.

- Suter Shield provides layer‑2 transaction privacy for Ethereum, BSC and other EVM chains.

- Market caps hover below $200K, trading volumes are near‑zero and the token has lost over 99% of its peak value.

- Adoption hinges on privacy demand and integration partnerships; the risk level is high for investors.

What Is Suterusu?

Suterusu is a privacy‑focused blockchain protocol that leverages zero‑knowledge proofs to hide transaction details while staying compatible with existing smart‑contract ecosystems. Launched on October42019, the project set out to give users the same auditability that regulators need without exposing amounts or participants.

Core Technology: zk‑SNARKs and the Academic Backbone

zk‑SNARKs (Zero‑Knowledge Succinct Non‑Interactive Arguments of Knowledge) are the cryptographic engine behind Suterusu’s privacy. They let one party prove a statement true-like “the sum of inputs equals the sum of outputs”-without revealing the numbers themselves. This approach keeps transaction size low and verification fast, which is crucial for a layer‑2 solution.

The research didn’t happen in a vacuum. Dr. Huang Lin, Suterusu’s CTO, co‑authored a paper on efficient range‑proof schemes with researchers from the CNRS (France) and Karlsruhe Institute of Technology (Germany). That paper was accepted at Eurocrypt2021, one of the most prestigious cryptography conferences. The peer‑reviewed work gives the protocol a solid academic footing and explains why Suterusu can claim “transparent setup” range proofs-a rare feature among privacy coins.

Tokenomics: The SUTER ERC‑20 Token

The native token, SUTER, is an ERC‑20 asset on Ethereum with a hard cap of 10billion tokens. It serves two roles:

- Governance: token holders vote on protocol upgrades, fee structures and bridge integrations.

- Staking rewards: the network runs a Proof‑of‑Stake (PoS) consensus where validators lock SUTER to secure the chain and earn fresh tokens.

Rewards are emitted at a rate of 3000 SUTER per minute, which translates to roughly 4.32million new tokens each day. Since launch, more than 2billion tokens have been distributed as staking rewards. Current circulating supply estimates vary between 3.7billion and 3.86billion depending on the data source.

All private‑round tokens unlocked by early2021 and the foundation’s allocation completed its vesting in late2022, meaning today’s supply is fully in the market.

Network Structure and Staking Landscape

The Suterusu network runs a PoS model with 47 active node operators and over 158000 participants who stake their SUTER. The staking rate consistently exceeds 80%, indicating strong validator interest despite thin trading liquidity.

Validators are rewarded every 60seconds, and the reward curve is designed to taper as the total supply nears the 10billion limit. This incentive structure keeps the network secure while gradually lowering inflation.

Suter Shield: Layer‑2 Privacy for Ethereum and Beyond

Suter Shield is the flagship product-a decentralized layer‑2 solution that encrypts transaction data before it lands on the base chain. Users deposit assets into a Shield contract, the protocol generates a zero‑knowledge proof, and the proof is posted on‑chain while the actual amounts stay hidden.

Because Shield is built on Ethereum’s roll‑up architecture, it can be bridged to other EVM‑compatible chains such as Binance Smart Chain (BSC) and Heco. Developers can integrate Shield into dApps with a few smart‑contract calls, gaining privacy without rewriting core business logic.

The multi‑chain compatibility positions Suterusu as an infrastructure layer rather than a stand‑alone coin, which could broaden its addressable market if privacy regulations tighten.

Market Performance: Price, Volume and Ranking

As of October2025, SUTER trades between $0.000021 and $0.000045, a 99% drop from its November2019 all‑time high of $0.08347. Market capitalization hovers around $170K (CoinMarketCap) with a fully diluted valuation just under $450K. Rankings fluctuate widely-some sites list it in the 2900‑range, others near 6300-reflecting low trading volume (often reported as $0 on a 24‑hour basis) and limited liquidity.

Technical indicators paint a mixed picture. The 50‑day SMA sits at $0.0000399, well below the 200‑day SMA of $0.000083, indicating a downtrend. RSI is near 36, suggesting the token may be approaching oversold territory but not yet in extreme distress. The Fear & Greed Index reads 73 (Greed), yet sentiment analyses on CoinCodex remain bearish.

Despite these numbers, the protocol’s TVL is about $216K, giving a market‑cap‑to‑TVL ratio of 0.80. That implies active usage in privacy‑focused dApps, even if traders aren’t swapping the token.

Price Outlook: 2025‑2030 Projections

Analysts differ widely. SwapSpace forecasts a 2025 range of $0.000030 to $0.000106, with $0.000059 as a consensus midpoint. For 2026, projections swing from $0.000003 to $0.000093. CoinCodex expects a modest 20% dip to $0.0000285 but sees a 31% upside if you hold through mid‑November2025. Long‑term (2030) views hover near $0.000059, indicating limited upside unless a major privacy‑regulation shift sparks renewed demand.

Given the token’s volatility (3%±daily swings) and the thin order books, any price move will likely be driven by news-new bridge integrations, audits, or regulatory developments.

How Suterusu Stacks Up Against Other Privacy Coins

| Feature | Suterusu (SUTER) | Monero (XMR) | Zcash (ZEC) |

|---|---|---|---|

| Privacy Tech | zk‑SNARKlayer‑2 | Ring signatures & confidential TX | zk‑SNARKs (on‑chain) |

| Chain | Ethereum‑compatible (EVM) | Own PoW/PoS chain | Own PoW chain (Zcash) |

| Governance Token | SUTER (ERC‑20) | None (XMR is native) | ZEC (native) |

| Market Cap (Oct2025) | ≈ $170K | ≈ $5B | ≈ $250M |

| Liquidity | Very low | High | Medium |

While Monero and Zcash dominate privacy‑coin market share, Suterusu’s differentiator is its layer‑2 model that can sit on top of any EVM chain. This could make it attractive for dApp developers who need privacy without launching a new base chain.

Risks and Considerations for Investors

1. Liquidity crunch: With daily volume often reported as $0, moving large amounts without slippage is tough.

2. Market positioning: Ranking below 3000 means most exchanges list SUTER on small, low‑volume platforms.

3. Regulatory pressure: Global scrutiny on privacy‑centric tokens could limit adoption or trigger delistings.

4. Technical maturity: While the Eurocrypt paper validates the cryptography, real‑world usage of Shield is still limited to a handful of dApps.

5. Opportunity: If a major privacy‑regulation emerges that forces enterprises to hide transaction data, Suter Shield could see a surge in demand, potentially boosting token utility.

Getting Started: How to Use Suter Shield

- Buy a small amount of SUTER on a supported exchange (e.g., KuCoin, PancakeSwap).

- Transfer the tokens to an Ethereum‑compatible wallet (MetaMask, Trust Wallet).

- Navigate to the official Suterusu website and click “Launch Suter Shield”.

- Deposit the desired amount into the Shield contract; the UI will display an estimated proof generation time (usually a few seconds).

- After the proof is posted, you receive a privacy‑wrapped version of your tokens that can be sent to any address without revealing amounts.

When you need to withdraw, simply reverse the process-your funds become transparent again on the base chain.

Future Development Roadmap

The team has hinted at three near‑term milestones:

- Integration of Suter Shield with popular DeFi protocols on BSC (e.g., PancakeSwap).

- Release of a privacy‑preserving NFT marketplace leveraging zero‑knowledge proof minting.

- Audits by top‑tier firms (Trail of Bits, Quantstamp) to strengthen security assurances.

Successful delivery could address the biggest criticism-lack of real‑world use cases-and attract institutional interest.

Frequently Asked Questions

What problem does Suterusu solve?

It gives developers a way to add transaction privacy to any EVM‑compatible chain without building a brand‑new blockchain, using zk‑SNARKs to hide amounts while keeping proofs short and cheap.

Is SUTER a good investment?

The token is highly speculative. Low liquidity, a 99% price collapse, and limited adoption make it risky. Only allocate money you can afford to lose.

How does Suter Shield differ from Monero?

Monero builds privacy into its own blockchain, while Suter Shield works as a layer‑2 on top of existing chains. That means you can use familiar DeFi tools and still hide transaction amounts.

Can I stake SUTER on Ethereum directly?

Staking is done through the native PoS validator set, not via the standard Ethereum 2.0 staking contract. You lock SUTER in the Suterusu validator interface to earn rewards.

Where can I find the latest Suterusu code updates?

All open‑source work lives on the project’s GitHub at github.com/suterusu-io. Releases are announced on Twitter @suterusu_io and the Reddit community r/Suterusu.

Kate Nicholls

July 15, 2025 AT 20:57 PMThe token’s liquidity is basically non‑existent, which makes any real‑world use a gamble you’d rather not take.

Amie Wilensky

July 19, 2025 AT 14:17 PMOne must ask, does the veneer of “layer‑2 privacy” truly shield users, or is it merely a clever marketing façade that hides the same traceability issues inherent to Ethereum’s public ledger?; moreover, the perpetual 3,000 SUTER per minute reward inflates supply faster than most projects can generate genuine demand.

MD Razu

July 23, 2025 AT 07:37 AMAt first glance Suterusu promises an elegant solution by grafting zk‑SNARKs onto existing EVM chains, a concept that sounds technically appealing. However, the practical implementation raises several red flags that merit careful scrutiny. The staking reward rate of 3,000 SUTER per minute translates to roughly 4.32 million SUTER minted each day, an inflationary pressure that dwarfs the modest market cap of approximately $170 K reported in October 2025. Such a supply surge inevitably dilutes existing holdings, eroding any potential price appreciation for early adopters.

Furthermore, the circulating supply represents only about 37.6 % of the total supply, indicating that a large portion remains locked or reserved, which could be released arbitrarily by the developers, further destabilising the token economics.

From a privacy perspective, while zk‑SNARKs provide strong cryptographic guarantees, their deployment on a public chain re‑introduces side‑channel risks, especially when transaction metadata is still observable.

Contrast this with Monero’s integrated ring signatures and confidential transactions, which were designed from the ground up to obscure amounts and participants without relying on external layers.

Moreover, the reliance on Ethereum’s gas market means that privacy‑preserving transactions can become prohibitively expensive during periods of network congestion, negating the user‑friendly narrative.

The comparison table also reveals that Suterusu’s liquidity is described as “very low,” a critical flaw that hampers the ability to enter or exit positions without slippage.

Low liquidity, combined with high inflation, creates a perfect storm for price volatility, making the token unsuitable for long‑term holding.

Investors should also consider the governance model: SUTER is an ERC‑20 governance token, yet the actual decision‑making power appears concentrated among a small core team, raising concerns about decentralisation.

Given these factors, the promised privacy advantage is arguably outweighed by economic and technical vulnerabilities that are difficult to mitigate.

Potential users must weigh the cost‑benefit ratio carefully, as the privacy gains may not justify the financial risk.

In summary, Suterusu offers an interesting experiment in layer‑2 privacy, but the overwhelming inflation, scarce liquidity, and dependency on Ethereum’s state make it a high‑risk proposition for most participants.

Future developments could address some of these issues, but until then, prudent investors would be wise to treat SUTER with skepticism.

Michael Wilkinson

July 27, 2025 AT 00:57 AMI respect the thorough analysis, yet dismissing the project outright ignores the potential for upcoming layer‑2 upgrades that could tame inflation and boost liquidity.

Jason Brittin

July 30, 2025 AT 18:17 PMOh great, another token that promises privacy while quietly printing coins like a broken ATM 🙃

Naomi Snelling

August 3, 2025 AT 11:37 AMWhat if the “broken ATM” is actually a deliberate backdoor engineered by the shadow consortium that controls the Ethereum mining pools?

Kate Roberge

August 7, 2025 AT 04:57 AMHonestly, the hype around SUTER feels like a desperate attempt to resurrect the dead meme‑coin market, and it’s bound to crash the moment anyone looks at the numbers.

Oreoluwa Towoju

August 10, 2025 AT 22:17 PMWhile the numbers are stark, new developers can still learn valuable privacy concepts from the codebase without necessarily investing.

Charles Banks Jr.

August 14, 2025 AT 15:37 PMSo, we’ve got a token that claims to be private, yet its roadmap is as opaque as a foggy London morning-surprising, really.

Ben Dwyer

August 18, 2025 AT 08:57 AMStay patient, keep studying the roadmap, and you’ll spot the real opportunities when they finally surface.

Lindsay Miller

August 22, 2025 AT 02:17 AMReading through the details, I feel it’s important to remind newcomers that high‑risk projects like this can be educational, even if they don’t pan out.

Katrinka Scribner

August 25, 2025 AT 19:37 PMTotally agree! It’s a fun ride to watch and learn, even if the price is a rollercoaster 🎢

VICKIE MALBRUE

August 29, 2025 AT 12:57 PMHopeful vibes for anyone daring to explore new privacy tech.

Waynne Kilian

September 2, 2025 AT 06:17 AMIn the grand tapestry of blockchain evolution, Suterusu represents a bold thread that, despite its flaws, weaves new patterns of privacy that may inspire future designs.

Clint Barnett

September 5, 2025 AT 23:37 PMWhen you look beyond the surface of SUTER’s market cap and focus on the underlying technology, you discover a playground of cryptographic experiments that could reshape how we think about transaction anonymity. The integration of zk‑SNARKs onto an EVM‑compatible chain is, in itself, a daring architectural choice that challenges the status quo and invites developers to push the boundaries of what is possible within the smart‑contract ecosystem. Moreover, the staking mechanism, albeit inflationary, serves as a live laboratory for testing incentive models that balance security, participation, and tokenomics-a balance that many legacy privacy coins have struggled to achieve. If you consider the broader narrative of privacy in crypto, Suterusu adds a valuable case study that highlights both the potential and the pitfalls of layering privacy solutions atop established infrastructures. This duality can spark insightful debates among researchers, prompting them to refine zero‑knowledge proof implementations, reduce gas costs, and perhaps even devise hybrid models that combine on‑chain and off‑chain privacy layers. While the current liquidity constraints limit immediate economic gains, the knowledge gained from interacting with this ecosystem could empower the next generation of privacy‑focused projects, making SUTER an educational stepping stone rather than a final destination. In short, treat this token as a sandbox for innovation, and you might walk away with insights that surpass any short‑term profit you could have earned.

Jacob Anderson

September 9, 2025 AT 16:57 PMLet’s be honest, the “privacy” claim is just a buzzword dress‑up for what is essentially another speculative token.

Carl Robertson

September 13, 2025 AT 10:17 AMIf I had a penny for every time a “privacy coin” promised the moon and delivered a puddle, I’d be able to fund an actual privacy research lab-so stop the melodrama already.

Rajini N

September 17, 2025 AT 03:37 AMTo sum up, anyone considering SUTER should first evaluate the inflation rate, liquidity depth, and actual privacy guarantees, then decide if those trade‑offs align with their risk tolerance and investment goals.