Glimpse IDO: Quick Insights into Crypto Token Launches

When you hear the term IDOs, Initial DEX Offerings are token sales that happen directly on decentralized exchanges. Also known as crypto token launches, an IDO lets developers raise funds while early backers can claim brand‑new assets without a central intermediary. That definition matters because an IDO encompasses token distribution, the process of allocating newly minted coins to participants and often pairs with a crypto airdrop, a free‑to‑claim token giveaway used to boost community interest. In practice, a successful IDO requires solid tokenomics, the economic model that defines supply, incentives and utility and a supportive DeFi launch platform, a decentralized finance protocol that hosts the sale and provides liquidity. Put simply, the IDO ecosystem is a chain of cause‑and‑effect relationships: good tokenomics influences audience trust, which boosts airdrop participation, which in turn drives liquidity on the DeFi launch platform. That chain is what you’ll see reflected across the guides below.

Why IDOs, Airdrops, and Token Distribution Matter Together

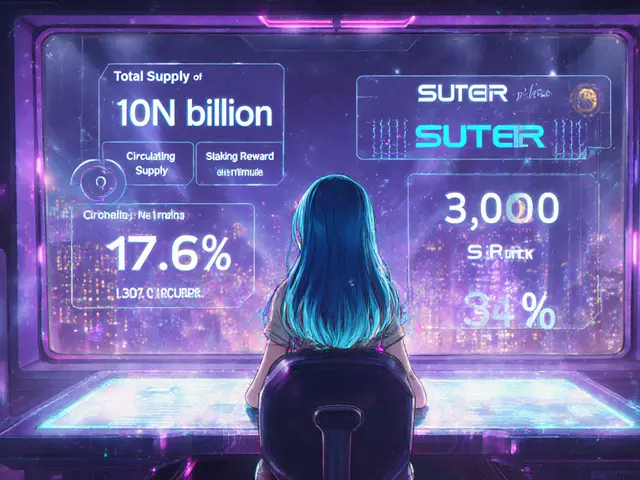

Imagine you’re evaluating a new project that just announced an IDO. The first thing you’ll check is the token distribution schedule – how many tokens go to the team, advisors, and the public. A fair distribution reduces the risk of price manipulation and signals long‑term commitment. Next, you’ll look at the airdrop details. A well‑structured airdrop can seed a vibrant community, generate buzz, and provide early liquidity for the token. Projects often tie airdrop eligibility to actions like following social channels or holding a partner token, which helps them gauge genuine interest. Tokenomics ties both pieces together. It dictates the total supply, emission rate, and utility of the token. If the tokenomics are transparent and align with real use‑cases – say, staking rewards on a DeFi protocol or governance rights on a DAO – users are more likely to hold rather than flip immediately after the IDO. Finally, the DeFi launch platform matters because it controls the smart contract that locks the funds, sets the price discovery mechanism, and provides the initial liquidity pool. Platforms that use audited contracts and offer built‑in anti‑whale measures add an extra layer of security for participants. By understanding how these entities intersect, you can spot red flags early. For example, a project that promises a massive airdrop but hides its token distribution plan may be trying to inflate hype without backing it up. Conversely, a balanced IDO with clear tokenomics, a modest airdrop, and a reputable DeFi launch platform usually indicates a healthier long‑term outlook.

Below you’ll find a curated collection of posts that break down each piece of the puzzle. From step‑by‑step airdrop guides to deep dives on tokenomics models and reviews of DeFi launch platforms, the articles give you practical tools to assess any IDO quickly. Dive in, compare the details, and use the insights to decide which token launches are worth your time and capital.

How to Claim the GLMS (Glimpse) IDO Airdrop - Step‑by‑Step Guide 2025

Discover how to claim the GLMS (Glimpse) IDO airdrop in 2025. Get eligibility details, step‑by‑step claim instructions, risk tips, and a FAQ for smooth processing.