Crypto Transaction Safety Checker

Check Your Transaction

Enter transaction details to see if it would likely be blocked by Alipay or WeChat Pay.

China doesn’t just ban cryptocurrency-it makes sure you can’t even pay for it. Since 2021, the government has outlawed all crypto trading, mining, and payments within its borders. But the real enforcement doesn’t come from police raids or court orders. It comes from your phone. Alipay and WeChat Pay are the gatekeepers. If you try to send money to a crypto exchange, the transaction dies before it leaves your screen.

How the Ban Actually Works

It’s not enough to make crypto illegal. You have to cut off the money flow. That’s where Alipay and WeChat Pay come in. Together, they handle over 90% of all digital payments in China. When you pay for groceries, split a restaurant bill, or send money to a friend, you’re using one of these two apps. The government didn’t need to build a new system. It just told these two giants: block anything crypto-related. The People’s Bank of China (PBOC) and other agencies like the National Administration of Financial Regulation (NAFR) and the Ministry of Public Security (MPS) require both platforms to monitor every transaction in real time. Their systems scan for keywords, wallet addresses, and patterns linked to crypto exchanges. If you try to pay a known Bitcoin OTC vendor, the payment gets rejected. No warning. No explanation. Just: "Transaction failed. Contact customer service." Even if you don’t know you’re trying to pay for crypto, the system catches it. Some users tried sending money to friends who ran crypto-related businesses. The payment got blocked because the recipient’s business category was flagged. Others tried buying gift cards that could be resold for crypto. Blocked. Even payments to online gaming sites that accept crypto as a reward got shut down.Why These Apps Are So Effective

Most countries regulate crypto through banks and exchanges. China doesn’t need to. It controls the payment layer-the actual movement of cash. Alipay and WeChat Pay are tied directly to bank accounts, ID verification, and mobile numbers. Every user is fully KYC’d. No anonymity. No privacy. No way around it. Unlike in the U.S. or Europe, where you can use a VPN and a foreign exchange to trade crypto, in China, you can’t even link a foreign card to Alipay or WeChat Pay. You can’t use PayPal. You can’t use Wise. The only way to move money digitally is through these two platforms-and they’re locked down. The system also works with state-owned banks. If a bank account shows repeated attempts to transfer funds to a crypto-linked merchant, the account gets flagged. The user might be called in for an interview. In some cases, accounts are frozen. The message is clear: don’t even try.WeChat Pay’s Hidden Loophole

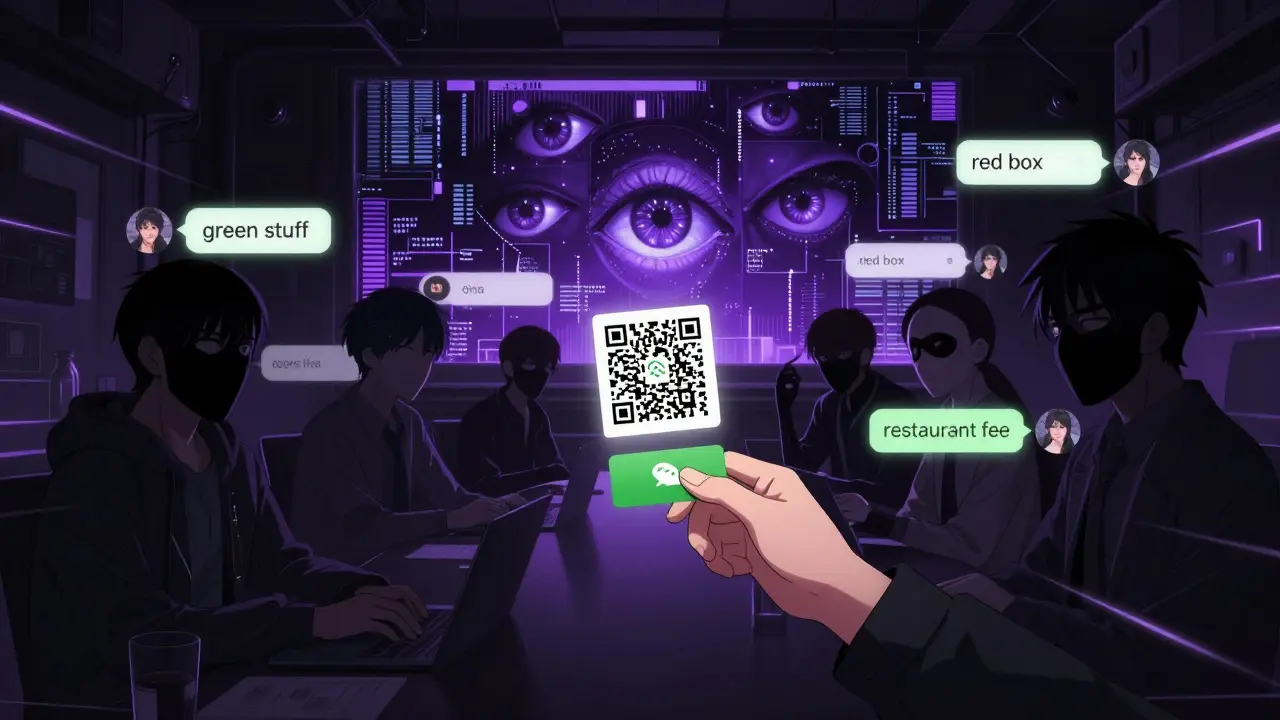

Here’s the twist: WeChat Pay isn’t just a payment app. It’s also a messaging app. And that’s where the cracks appear. Criminals and crypto users have learned to use WeChat’s chat feature to coordinate trades. Someone will message a wallet address. Then they’ll send a QR code for a payment-say, for a fake "online service"-that’s actually meant to buy crypto. The payment goes through WeChat Pay, but the crypto transfer happens off-platform, using a foreign exchange or peer-to-peer network. Because WeChat’s messages are encrypted and not shared with foreign authorities, regulators can’t see the planning. They can only see the payment. And if that payment is labeled as "restaurant fee" or "consulting service," it slips through. This has led to a growing underground market. People use WeChat groups to find OTC traders. They arrange deals in private chats. They use coded language: "I need 0.5 of the green stuff" means Bitcoin. "The red box" means Ethereum. The payment goes through WeChat Pay. The crypto arrives in a wallet overseas. It’s risky. If caught, users face fines, account freezes, or even criminal charges for illegal capital outflow. But the demand hasn’t disappeared. It’s just gone underground.

What’s Not Allowed

The ban is total. No retail crypto payments. No crypto-to-fiat exchanges. No stablecoin use for everyday transactions-even if they’re pegged to the yuan. Even crypto-based loyalty programs are banned. If a store tries to offer discounts in Bitcoin, Alipay and WeChat Pay will block their merchant account. The only exception is the government’s own digital currency: the e-CNY. That’s not crypto. It’s a state-controlled digital yuan, distributed through the same apps. You can pay for bus rides, groceries, or subway tickets with e-CNY. But you can’t trade it. You can’t send it overseas. You can’t mine it. It’s just digital cash-with no blockchain. This distinction matters. The government isn’t against digital money. It’s against decentralized money. Alipay and WeChat Pay are now the delivery channels for the e-CNY, not the blockers of crypto. The same infrastructure, two different purposes.How Users Are Adapting

Most Chinese citizens follow the rules. They don’t want their accounts frozen or their names on a government watchlist. But a small group-mostly tech-savvy traders, overseas workers, and business owners-have found workarounds. Some use foreign apps like Paxful or LocalBitcoins, but they need to move money out of China first. That’s where underground money changers come in. You give them cash in China. They send crypto to your wallet overseas. It’s slow, expensive, and risky-but it works. Others use crypto ATMs in Hong Kong or Macau. They travel there, buy Bitcoin, and bring it back. But bringing crypto into China is illegal. If customs finds it, they seize it. And if you’re caught trading it later, you’re on the hook. A few have turned to decentralized exchanges (DEXs) and self-custody wallets. But without access to Alipay or WeChat Pay, funding those wallets is nearly impossible. You’d need a foreign bank account, a crypto-friendly exchange, and a way to transfer money without triggering alerts. Few have the resources.The Future: More Tech, Less Flexibility

China’s crypto ban isn’t easing. In July 2025, the Shanghai State-owned Assets Supervision and Administration Commission hinted at possible changes, but no laws have been updated. The government’s position remains: crypto is a financial risk, a threat to capital controls, and a tool for money laundering. What’s changing is the tech. Alipay and WeChat Pay are now using AI to detect even subtle patterns. If you suddenly start sending small payments to 10 different accounts every week, the system flags it. If your spending habits shift from groceries to gaming credits, it watches. The system learns. The next step? Real-time blockchain analysis. Some tools can trace crypto movements across public ledgers. If you buy Bitcoin on an offshore exchange and then send it to a wallet linked to a Chinese phone number, regulators might not catch it immediately. But if that wallet later receives a payment from a WeChat Pay user, the trail gets hot. The goal isn’t to catch every user. It’s to make it so hard, so slow, and so risky that most people just give up.

How This Compares to Other Countries

Singapore lets you trade crypto legally. Hong Kong licenses exchanges. Japan and South Korea have clear rules. China? No licenses. No legal trading. No retail access. It’s the strictest approach in Asia. Even Vietnam and Thailand, which have had crypto crackdowns, still allow some OTC trading. China doesn’t. Not even a little. The only other country with similar control is North Korea. But there, it’s about evasion. In China, it’s about compliance.What Happens If You Try to Break the Rules

If you’re caught using Alipay or WeChat Pay for crypto, the consequences vary. For a first-time offender, your account gets suspended for 30 days. You get a warning. You’re told to stop. Repeat offenders? Account permanently closed. Your ID flagged. You can’t open another account under your name for years. If you’re a business owner, your merchant license gets revoked. If you’re moving large sums, you could face criminal charges under China’s Anti-Money Laundering Law. In 2024, over 12,000 cases of crypto-related financial violations were investigated. Over 3,000 resulted in fines or arrests. Most involved WeChat Pay coordination. The message isn’t hidden: the state controls the money. Not you. Not Bitcoin. Not Ethereum. Not even a stablecoin.Final Reality Check

Alipay and WeChat Pay didn’t invent the crypto ban. But they made it unstoppable. By controlling the payment layer, China turned two apps into the most effective crypto enforcement tools on Earth. You can still buy crypto. You just can’t use your phone to do it. And that’s the point. The future of money in China isn’t decentralized. It’s digital. And it’s owned by the state.Can I still use Alipay or WeChat Pay if I own cryptocurrency?

Yes, you can still use Alipay and WeChat Pay for everyday payments like shopping, bills, and transfers. Owning crypto doesn’t automatically block your account. But if you try to send money to a crypto exchange, OTC vendor, or wallet address linked to crypto, the transaction will be blocked. Your account may also be flagged for review if your spending patterns change suddenly.

Is it legal to buy crypto on foreign exchanges while in China?

Buying crypto on foreign exchanges isn’t explicitly illegal, but funding those purchases through Alipay or WeChat Pay is. If you use a Chinese bank account or payment app to send money to a foreign exchange, it will be blocked. You’d need a foreign bank account, cash transfers through underground channels, or physical travel to fund it-each carrying legal risks. The government considers this a violation of capital control rules.

Can I use WeChat chat to coordinate crypto trades?

Using WeChat to communicate about crypto trades is a gray area. The platform doesn’t scan encrypted messages for crypto-related terms, so many users do it. But if those chats lead to payments through WeChat Pay that are later flagged, you can be investigated. Authorities don’t prosecute chat alone-but they use it as evidence when combined with financial activity. It’s risky and increasingly monitored.

What’s the difference between e-CNY and Bitcoin?

e-CNY is China’s central bank digital currency-it’s digital yuan, issued and controlled by the government. It’s not based on blockchain, can’t be mined, and can’t be transferred outside the system. Bitcoin is decentralized, publicly traded, and operates on a global blockchain. Alipay and WeChat Pay support e-CNY as a payment tool but block Bitcoin and other private cryptocurrencies entirely.

Are there any legal ways to invest in crypto from China?

No. There are no legal domestic exchanges or investment products for crypto in mainland China. Even ETFs or crypto-related stocks listed overseas are off-limits for retail investors using Chinese payment systems. The only legal option is to hold crypto outside China, funded through non-Chinese channels-but this still violates capital control rules and carries serious legal consequences if detected.

Patricia Amarante

December 15, 2025 AT 18:07 PMWow, I just realized how much control these apps have over daily life. It's wild that your phone can literally decide what you're allowed to spend money on.

Elvis Lam

December 16, 2025 AT 13:41 PMThis isn't just a ban-it's a total infrastructure takeover. China didn't need to outlaw crypto with laws; they just made the payment layer a state monopoly. Brilliant. Terrifying. Either way, it works.

Jonny Cena

December 18, 2025 AT 04:54 AMI get why people are scared. Imagine being told you can't pay for something-even if it's legal elsewhere-because an algorithm flagged your spending pattern. It’s not about safety anymore. It’s about control. And the worst part? Most people don’t even notice they’re being watched.

Amy Copeland

December 19, 2025 AT 15:01 PMOh honey, you think this is extreme? Wait till you see how they track your menstrual cycle through e-CNY spending habits. Next thing you know, you’re flagged for 'irrational emotional expenditures' and banned from buying tofu.

Timothy Slazyk

December 21, 2025 AT 08:55 AMWhat’s fascinating isn’t the ban-it’s the psychological shift. People don’t resist because they don’t perceive it as oppression. They perceive it as convenience. Why bother with crypto when your phone pays for everything faster, cleaner, and without the headache? The state didn’t crush freedom-it replaced it with comfort. And comfort, as history shows, is the most effective cage.

Samantha West

December 22, 2025 AT 15:13 PMLet me just say this the government is not your friend and if you think this is about financial stability you are delusional this is about power and control and they are using your own technology to do it and no one talks about how this sets a precedent for the entire world

Donna Goines

December 22, 2025 AT 16:11 PMThey’re using AI to track crypto patterns? Yeah right. That’s just the cover. The real system is run by quantum computers in underground bunkers that read your thoughts through your phone’s microphone. They know you’re thinking about Bitcoin even before you type it. That’s why your payment gets blocked before you hit send. They’ve already seen your soul.

Sean Kerr

December 23, 2025 AT 15:19 PMBroooooo… this is next level 😳 Like… imagine trying to send $5 to your homie for ramen and your phone says ‘transaction failed’ like what even is this?? 😭 I mean… I get it… but also… why does my phone feel like my mom??

Kelsey Stephens

December 24, 2025 AT 05:28 AMIt’s sad how many people don’t realize this is the future everywhere. We’re just seeing it first in China. The convenience of centralized digital money is too tempting to resist-even if it means giving up your financial privacy. I’m not judging, just… observing.

Abby Daguindal

December 24, 2025 AT 21:08 PMSo you’re telling me that if I use WeChat to send a QR code for a fake ‘consulting fee’ to buy Bitcoin, I’m technically not breaking the law? Just… creatively circumventing state financial surveillance? How poetic.

Mark Cook

December 25, 2025 AT 06:11 AMWait wait wait-so you’re saying the Chinese government is more effective at banning crypto than the entire U.S. Congress? That’s not a win for China. That’s a win for authoritarianism. And honestly? I’m terrified.

Jack Daniels

December 26, 2025 AT 07:14 AM...I used to think blockchain was freedom... now I just feel like a ghost in a machine... they know everything... and they don’t even need to say it out loud...

Cheyenne Cotter

December 27, 2025 AT 08:31 AMPeople keep talking about Alipay and WeChat Pay like they’re villains, but honestly, they’re just doing what they were told. The real villains are the bureaucrats in Beijing who turned payment apps into surveillance tools. The apps didn’t ask for this. They just got a memo. And now they’re the face of the regime. It’s a system problem, not a tech problem.

Jesse Messiah

December 28, 2025 AT 16:08 PMso like… if i use e-cny to buy coffee… that’s cool right? but if i try to buy bitcoin with the same phone… boom… blocked? so its not about crypto… its about who controls the money? like… the state gets to decide what money is real? that’s wild. i mean… kinda makes sense? but also… kinda terrifying? 😅

Sally Valdez

December 29, 2025 AT 19:59 PMChina’s not banning crypto because it’s dangerous-it’s banning it because it’s American. You think Bitcoin is decentralized? It’s a Western tool for undermining sovereignty. WeChat Pay isn’t a tool of oppression-it’s a shield. And if you don’t get that, you’re part of the problem.

Sammy Tam

December 30, 2025 AT 19:01 PMImagine if your Uber app could block you from tipping your driver if they were ‘suspicious.’ That’s what’s happening here. The system doesn’t just monitor-it predicts. It doesn’t just block-it punishes by silence. No warning. No appeal. Just… gone. And the scariest part? You’ll probably never know why.

Emma Sherwood

December 31, 2025 AT 06:52 AMAs someone who grew up in a country where cash was king, watching China’s digital transformation is like seeing the future of governance-fast, seamless, and utterly inescapable. The e-CNY isn’t just digital money. It’s digital citizenship. And if you don’t play by its rules? You’re not just broke. You’re invisible.

Rebecca Kotnik

January 1, 2026 AT 13:36 PMThe philosophical implications of this system are staggering. We’ve moved from monetary policy to behavioral engineering. The state doesn’t just regulate transactions-it shapes habits, suppresses dissent, and normalizes surveillance under the guise of convenience. The absence of choice becomes the most powerful form of control. We’ve seen authoritarian regimes use propaganda, censorship, and fear. China has done something more insidious: it made compliance feel like convenience. And in doing so, it rendered resistance not only futile, but irrational. The most dangerous form of oppression isn’t the one you can see-it’s the one you’ve learned to love.