Beneficial Ownership: What It Is and Why It Matters

When dealing with beneficial ownership, the legal right to enjoy profits and control over an asset, even if the asset is registered in another name. Also known as ultimate ownership, it sits at the heart of financial transparency. In plain terms, it answers the question: who really pulls the strings behind a company, a wallet, or a token? Understanding this helps regulators stop illicit cash flow, lets investors assess true risk, and gives traders clearer insight into who might move markets.

Key Pillars That Support Beneficial Ownership in Crypto

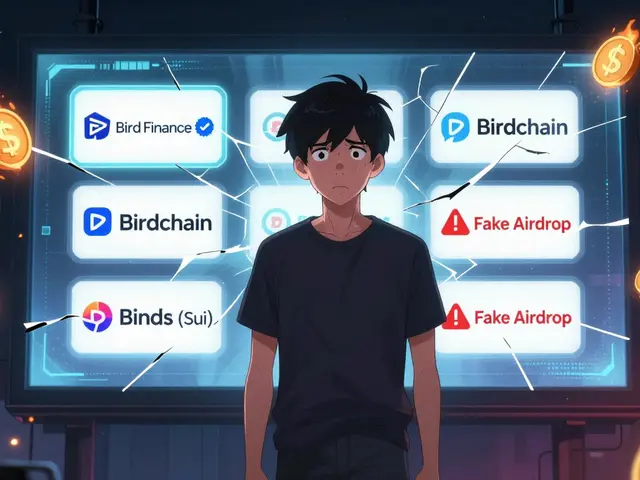

Effective Anti-Money Laundering, a framework of laws and procedures designed to stop illegal financing (AML) relies on accurate identification of the ultimate owners. Know Your Customer, the process of verifying a client’s identity before establishing a relationship (KYC) supplies the data needed to map ownership chains. Blockchain transparency, the ability to view transaction histories on a public ledger adds a new layer of verifiability, letting auditors follow funds from a token back to the real‑world entity. These three pillars create a semantic triple: beneficial ownership requires AML and KYC, while blockchain transparency enables the verification process. In practice, a crypto exchange must collect KYC documents, run AML checks, and then record wallet addresses on‑chain so that regulators can trace the flow of assets. If any link in that chain breaks, compliance teams lose sight of the true owner, opening the door to money‑laundering, sanctions evasion, or fraud. Beyond the traditional finance world, Decentralized Finance, an ecosystem of financial services built on smart contracts without intermediaries (DeFi) faces a unique hurdle: there is no central authority to enforce AML/KYC. Some platforms embed ownership data directly into smart contracts, while others partner with third‑party identity providers. The tension between privacy and transparency fuels ongoing debates about how DeFi can stay compliant without sacrificing its core ethos.

Whether you’re a merchant adopting crypto payments, a trader looking at tokenomics, or an investor assessing a new DePIN project, the concept of beneficial ownership shapes the risk landscape. Companies that ignore it risk regulatory fines, loss of reputation, or being blacklisted by major exchanges. Conversely, those that master ownership tracing can unlock smoother cross‑border transactions, gain trust from institutional partners, and avoid costly compliance hiccups.

Below you’ll find a hand‑picked selection of articles that break down these ideas further. From practical guides on AML‑ready crypto payments to deep dives into how cross‑chain bridges handle ownership data, the collection gives you concrete tools and real‑world examples to navigate the ownership puzzle in today’s fast‑moving markets.

Global KYC Regulations by Jurisdiction: 2025 Compliance Guide

A 2025 guide breaking down KYC regulations across the US, EU, Asia‑Pacific, Middle East and Latin America, with penalties, tech trends, checklists and FAQs.