Cryptocurrency Legality in Nigeria

When talking about cryptocurrency legality in Nigeria, the set of rules that decide whether digital assets can be bought, sold or used in the country. Also known as crypto regulation Nigeria, it shapes how investors, startups and everyday users interact with blockchain tech. The Central Bank of Nigeria, the nation’s monetary authority that issues the naira and oversees financial stability plays the leading role, issuing circulars that define what’s allowed and what isn’t. In practice, cryptocurrency legality in Nigeria determines if you can hold Bitcoin, trade on local exchanges, or need to report transactions under anti‑money‑laundering (AML) rules.

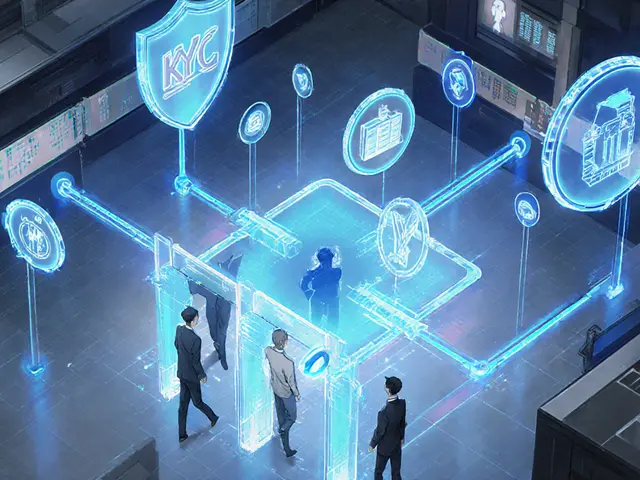

One of the biggest subtopics is the status of Bitcoin, the first and most widely recognized cryptocurrency. The CBN treats Bitcoin as a non‑legal tender, meaning you can own it but you can’t use it to pay for goods directly. This distinction creates a gray area for merchants who accept crypto via third‑party wallets. Meanwhile, crypto exchanges, platforms that let users swap fiat for digital tokens and vice versa must register with the Securities and Exchange Commission (SEC) and adhere to stringent KYC protocols. Those exchanges that ignore the licensing requirement risk being shut down, and users could lose access to their funds.

Key regulatory pillars shaping the crypto scene

Three core pillars drive the regulatory environment. First, the CBN’s circulars on digital assets set the macro policy – they ban banks from offering crypto services and warn about fraud. Second, the SEC’s licensing framework creates a pathway for compliant exchanges to operate, requiring capital reserves and regular reporting. Third, the Financial Intelligence Unit (FIU) enforces AML and combating the financing of terrorism (CFT) rules, demanding transaction monitoring and suspicious activity reporting. Together, these pillars form a chain: the Central Bank of Nigeria issues policy, the SEC issues licenses, and the FIU enforces AML compliance. Understanding how they interact helps anyone navigate the market without running afoul of the law.

For investors, the practical impact is clear. If you want to buy Bitcoin, you’ll likely go through a licensed exchange that has completed KYC checks. Those exchanges must keep records of every trade, flagging large or irregular movements for the FIU. This means your wallet balances are not completely anonymous – the regulator can trace activity back to an individual if needed. On the flip side, the rules also protect you from rogue platforms that disappear with user funds, a common problem in unregulated markets.

Businesses looking to accept crypto face a different set of choices. Some choose to partner with payment processors that convert crypto payments to naira instantly, staying within the CBN’s fiat‑only framework. Others adopt a hybrid model: they accept Bitcoin on‑chain but immediately move it to a regulated exchange, ensuring the transaction complies with AML reporting. Both approaches respect the current legal view that crypto is an asset, not a currency, and they avoid penalties for unauthorized fiat‑crypto bridging.

Regulators are not standing still. Recent drafts suggest the government may introduce a specific digital asset tax and tighter reporting thresholds for high‑volume traders. Those changes would add another layer to the compliance checklist, but they also signal a maturing market where crypto is seen as a taxable, reportable asset class. Keeping an eye on CBN announcements and SEC licensing updates is essential for staying ahead of any new obligations.

In short, Nigeria’s crypto landscape is built on three intersecting entities: the Central Bank’s policy, the SEC’s licensing, and the FIU’s AML enforcement. Each influences how Bitcoin is treated, how exchanges operate, and what traders and businesses must do to stay legal. Below you’ll find detailed posts that break down each piece, from exchange reviews and AML guides to the latest policy tweaks, giving you the tools to trade, invest, or build with confidence in Nigeria’s evolving regulatory world.

Crypto Payments in Nigeria: Legal Status, How to Use Them and What to Expect

Discover if crypto payments are allowed in Nigeria, the regulatory framework, licensing, tax rules, and how to use crypto legally for everyday transactions.