Investment Strategy: Build, Optimize, and Profit

When working with Investment Strategy, a structured approach for allocating capital to reach financial goals. Also known as investment plan, it guides every decision you make in the market. A solid strategy encompasses Risk Assessment, the process of evaluating potential losses against expected returns, and Portfolio Diversification, spreading investments across assets to reduce exposure to any single risk. Modern investors also look at Restaking, leveraging the same staked tokens to secure multiple protocols and boost yields, which directly influences how you allocate capital. By linking risk assessment, diversification, and restaking, an investment strategy becomes a dynamic tool that adapts to market shifts while keeping your goals in focus.

Key Concepts in Modern Investment Strategy

First, risk assessment isn’t just a checklist; it’s an ongoing conversation with the market. You compare volatility, regulatory changes, and liquidity to decide how much you can afford to lose on a trade. Next, portfolio diversification spreads that risk across cryptocurrencies, stocks, and even emerging assets like NFTs, ensuring that a dip in one area doesn’t sink the whole ship. In the crypto world, crypto staking adds a passive income layer, letting you earn rewards while holding assets. When you combine staking with restaking, you multiply that income by allowing the same tokens to back multiple protocols—think of it as earning interest on interest without re‑investing the original capital. This cascade of yields reshapes the risk‑return profile of your portfolio, making it more efficient without sacrificing safety.

Putting it all together, an effective investment strategy requires tools, data, and discipline. Real‑time price dashboards, technical indicators, and curated news feeds help you spot opportunities and spot threats early. Practical steps include setting clear entry and exit points, using stop‑loss orders, and regularly rebalancing to maintain your diversification targets. When you layer restaking on top of a diversified, risk‑managed portfolio, you unlock higher capital efficiency—a growing trend among savvy traders. Below you’ll find a curated collection of articles that walk through everything from exchange reviews and regulatory guides to deep dives on restaking, NFT standards, and risk management techniques. Dive in to sharpen your strategy, expand your toolkit, and stay ahead of market moves.

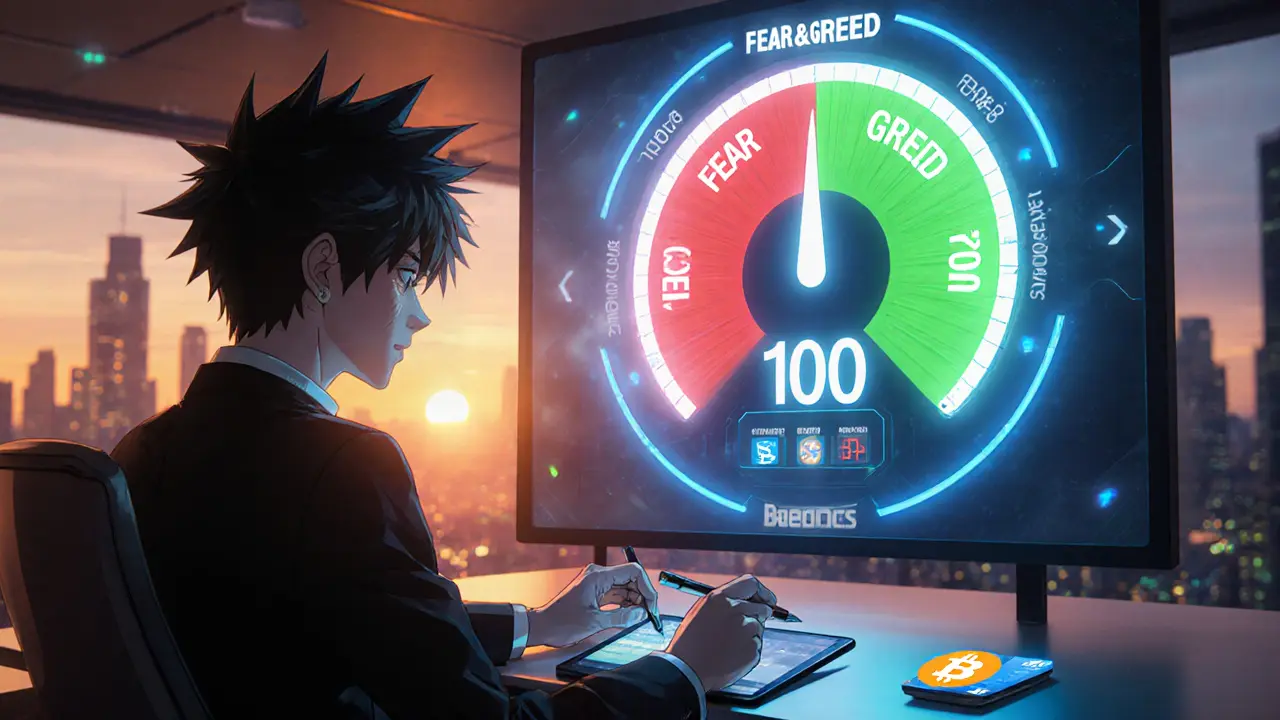

Fear and Greed Index Explained: How Market Sentiment Impacts Stocks & Crypto

Learn how the Fear and Greed Index works, its seven components, stock vs. crypto versions, and practical ways to use it for better investment decisions.