Market Sentiment in Crypto

When working with market sentiment, the collective mood of traders that drives price swings in real time. Also known as sentiment analysis, it blends social chatter, news flow, and on‑chain data to show whether optimism or fear is dominating the market. Understanding this feeling is the first step to spotting opportunities before the crowd reacts.

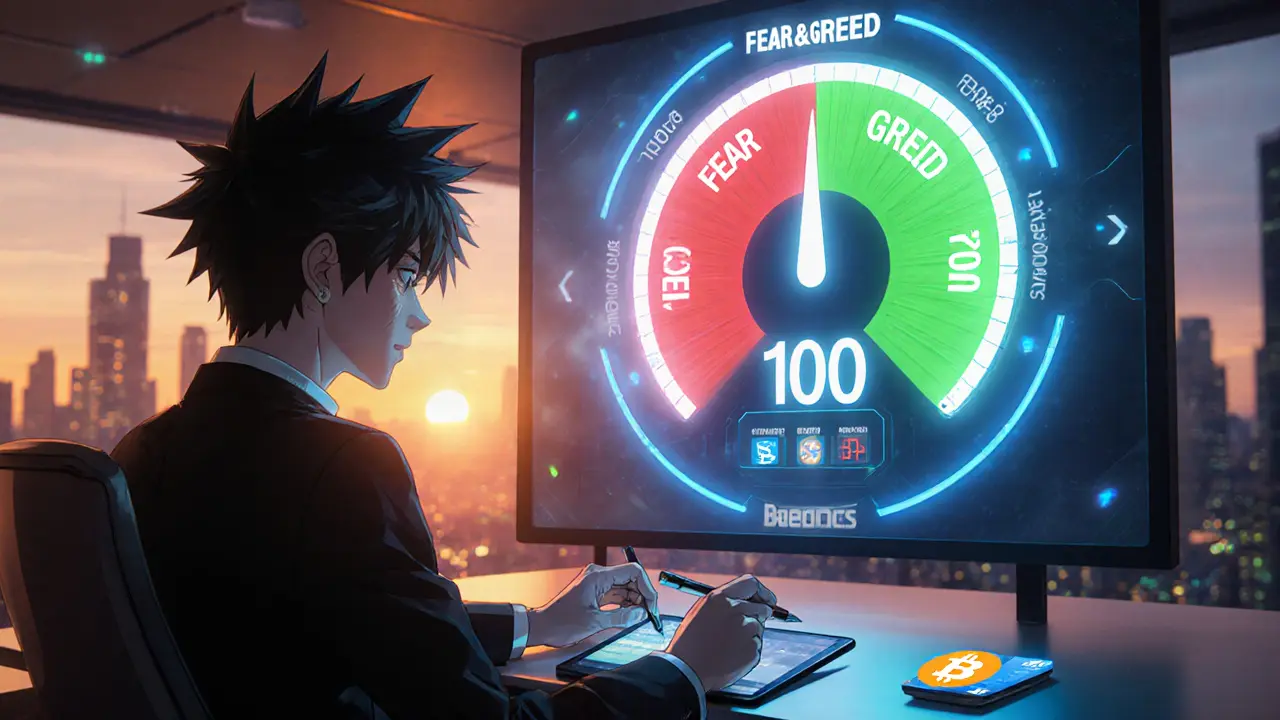

In practice, crypto market, the ecosystem of Bitcoin, Ethereum, altcoins and tokenized assets supplies the raw inputs – price spikes, volume bursts, and exchange order books – that sentiment models consume. Meanwhile, technical indicators, quantitative tools like RSI, MACD and Bollinger Bands act as the lenses that turn raw price action into readable signals. When the RSI climbs above 70, for example, it often flags an over‑bought mood; a sudden drop in the Fear & Greed Index can signal rising dread among holders.

Why Sentiment Matters for Traders

Market sentiment influences entry points, stop‑loss placement, and position sizing. A bullish wave fueled by positive regulatory news – say, the UK’s new crypto framework – can push prices higher even if fundamentals lag. Conversely, a crackdown in a major jurisdiction can trigger panic selling, amplifying losses for those who ignored the sentiment cue. In our post collection you’ll see examples from Costa Rica’s regulatory stance to the UK’s HM Treasury policy, showing how jurisdiction‑level news reshapes sentiment across the crypto landscape.

Sentiment also intertwines with trading psychology. Fear drives rapid exits, greed fuels over‑leverage, and herd behavior creates self‑fulfilling price moves. Articles on restaking, airdrop hype, and NFT standards illustrate how hype cycles can inflate sentiment, while warnings about double‑spending attacks or high‑risk exchanges remind us that fear can be a protective signal. Recognizing the emotional undercurrent lets you ride the wave instead of being knocked off the board.

Our curated guides break down the mechanics: from measuring sentiment with on‑chain metrics to interpreting news impact on specific assets like BiorLabs or BoxBet. You’ll find step‑by‑step checklists for verifying airdrop claims, deep dives into exchange risk, and practical tips on using sentiment‑aware trading dashboards. By the time you scroll past this intro, you’ll have a clear mental model of how market sentiment, technical indicators, and regulatory headlines combine to shape price action.

Ready to see sentiment in action? Below you’ll discover a range of articles that map sentiment cues to real‑world trading decisions, helping you turn mood swings into measurable opportunities.

Fear and Greed Index Explained: How Market Sentiment Impacts Stocks & Crypto

Learn how the Fear and Greed Index works, its seven components, stock vs. crypto versions, and practical ways to use it for better investment decisions.