Restaking Explained: Boost Your Crypto Yield

When working with restaking, the practice of re‑using already staked assets to earn extra rewards on other platforms. Also known as re‑staking, it relies on liquid staking, tokenized representations of staked coins that can be moved freely and staking derivatives, financial contracts that mirror staking returns without locking the underlying assets. Together they let a validator, the node that secures a proof‑of‑stake network or any DeFi participant layer more yield on top of the base staking reward.

Key Concepts and Risks

Restaking restaking encompasses chaining of staking rewards, meaning the second protocol pays interest on the first protocol’s tokenized stake. Liquid staking provides the tradable tokens that make restaking possible, turning a locked‑up position into a fluid asset. Staking derivatives amplify returns for validators by offering leveraged exposure without extra hardware. DeFi platforms integrate restaking to boost yields, but each step adds smart‑contract risk, slashing risk, and liquidity risk. Risk management influences restaking decisions, so users should assess the combined TVL, validator reputation, and code audits before stacking layers.

In practice, a user might lock ETH on a liquid‑staking service, receive stETH, then feed that token into a yield‑optimizing vault that issues staking‑derivative shares. That vault could, in turn, lend the shares to a lending protocol that pays interest, effectively restaking the original stake three times. The upside looks attractive, yet the downside can compound: a bug in any contract or a slash event on the original validator can wipe out the entire stack. Understanding how each entity interacts helps you spot where the chain could break.

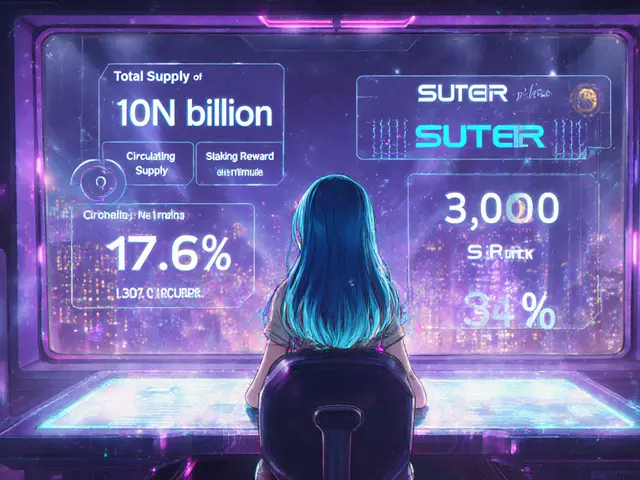

The articles below cover everything from exchange reviews to tokenomics, but the restaking theme ties them together. You'll find deep dives on liquid‑staking providers, risk‑mitigation strategies for staking derivatives, and real‑world examples of validators boosting yields through DeFi. Dive in to see how you can apply these concepts to your portfolio while staying aware of the pitfalls.

Restaking: Boosting Capital Efficiency in Crypto

Learn how restaking lets the same crypto stake secure multiple protocols, boosting yields and capital efficiency while outlining the risks, setup steps, and market outlook.