SyncSwap Linea – Fast, Low‑Fee DEX on Ethereum’s Linea L2

When exploring SyncSwap Linea, a decentralized exchange built on the Linea Layer‑2 network. Also known as SyncSwap on Linea, it offers instant swaps and tiny gas costs. Automated Market Maker, the core trading engine that prices assets via liquidity pools powers every trade, while Liquidity Mining, a rewards program that pays users for supplying liquidity turns users into active market makers. What makes SyncSwap Linea stand out is its blend of speed, cheap fees, and solid token incentives.

Why SyncSwap Linea matters

Linea is an Ethereum Layer‑2 rollup that squeezes transaction costs down to a few cents and finalizes blocks in seconds. Because Linea, the underlying rollup, handles batch processing off‑chain, SyncSwap users avoid the pricey gas spikes that hit Ethereum mainnet. The result is a smoother experience for traders who want to move in and out of positions quickly. In practice, this means you can execute arbitrage or day‑trade without watching your wallet drain.

SyncSwap Linea encompasses an Automated Market Maker that automatically adjusts prices based on pool depth. This AMM model requires liquidity providers to lock assets into smart contracts, which in turn creates the pool’s price curve. The more diverse the assets in a pool, the less slippage you’ll feel when swapping large amounts. That’s why many traders pair SyncSwap with other DeFi tools – the AMM gives you predictable pricing while the L2 guarantees fast settlement.

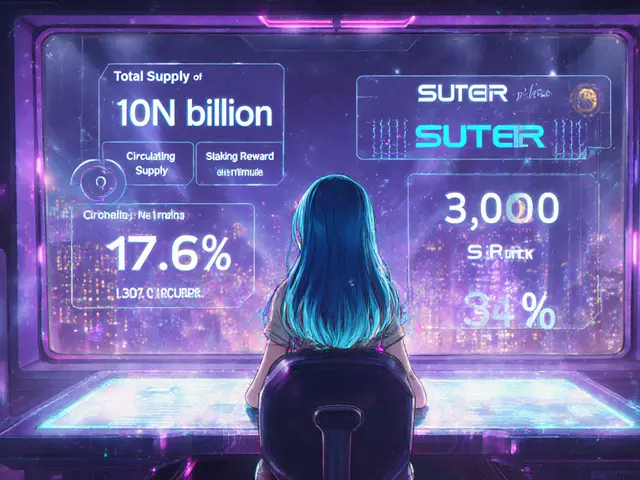

Liquidity mining on SyncSwap Linea incentivizes users to add capital to pools by handing out reward tokens. These rewards often come from the platform’s native token, which can be staked for extra yield or used in governance votes. The more you stake, the higher your share of the fees collected from every swap. This creates a virtuous loop: deeper pools mean better prices, which attract more traders, which generate more fees to share back with providers.

Cross‑chain bridging is another piece of the puzzle. SyncSwap Linea integrates with popular bridges that let you move assets from Ethereum, Binance Smart Chain, or other L2s into Linea with just a few clicks. By enabling seamless asset transfers, the platform expands the pool of usable tokens, fostering more diverse trading pairs. This flexibility is crucial for users who hold tokens across multiple ecosystems and want to avoid the hassle of separate wallets.

The user interface is built for both newcomers and seasoned traders. You’ll find a clean dashboard that shows real‑time pool stats, reward rates, and transaction history. Quick‑swap buttons let you execute trades with one click, while advanced settings let you set slippage limits or view historical price charts. The design mirrors familiar DEX layouts, so you won’t need a steep learning curve to start swapping.

Security can’t be an afterthought. SyncSwap Linea’s smart contracts have undergone multiple audits by reputable firms, and the platform runs a bug‑bounty program to catch any hidden issues. Because Linea inherits Ethereum’s security model, the underlying rollup is continuously verified by the Ethereum network. This dual‑layer approach gives you confidence that your funds are safe while you chase yields.

Community governance rounds out the experience. Token holders can propose changes to fee structures, add new trading pairs, or adjust reward distributions. By participating in votes, you help shape the future of the platform and ensure it stays aligned with user needs. Whether you’re here for cheap swaps, high‑yield farming, or a voice in the roadmap, SyncSwap Linea offers the tools to get there.

Below you’ll find a curated set of articles that dig deeper into each of these topics – from detailed AMM mechanics to step‑by‑step guides on bridging assets into Linea. Explore them to sharpen your strategy and make the most of what SyncSwap Linea has to offer.

SyncSwap (Linea) Review: zkRollup DEX for Stablecoin Swaps

A practical review of SyncSwap on the Linea zkEVM, covering its zero‑knowledge tech, liquidity, SYNC token, pros, cons, and step‑by‑step guide for traders.