By December 2025, the BIRD airdrop by Bird Finance remains one of the most confusing stories in DeFi. If you're reading this, you probably saw a post, a Telegram message, or a tweet claiming you’re eligible for free BIRD tokens. Maybe you even signed up. But here’s the truth: no official BIRD airdrop from Bird Finance has been confirmed to have taken place. And the reason isn’t just delay-it’s chaos.

What Is Bird Finance?

Bird Finance is a decentralized finance (DeFi) platform built around automated yield optimization. It doesn’t just let you stake tokens-it finds the best pools across multiple blockchains, compounds your rewards automatically, and rewards you with its native token, BIRD. The platform works on Solana, HECO, OKExChain, and Ethereum, pulling liquidity from different chains to maximize returns. Think of it like a robo-advisor for DeFi, but with a deflationary twist.

The BIRD token supply started at 1 billion tokens. Half of that-500 million-was instantly sent to a blackhole address, meaning it’s gone forever. Every time someone trades BIRD, a 6% fee is applied. Two percent goes to the liquidity pool, two percent to the DAO treasury for community votes, and two percent is distributed to all existing BIRD holders. That means holding BIRD gives you passive income just by owning it-and the total supply keeps shrinking.

The Airdrop That Never Came

Early in 2024, Bird Finance announced an airdrop. The plan? Give BIRD tokens to early supporters who held specific assets, followed social media accounts, joined Discord, and completed tasks. The target date? November 30, 2024. Then it shifted to Q1 2025. Now, it’s December 2025. No tokens were distributed. No official update. No blockchain transaction confirming distribution.

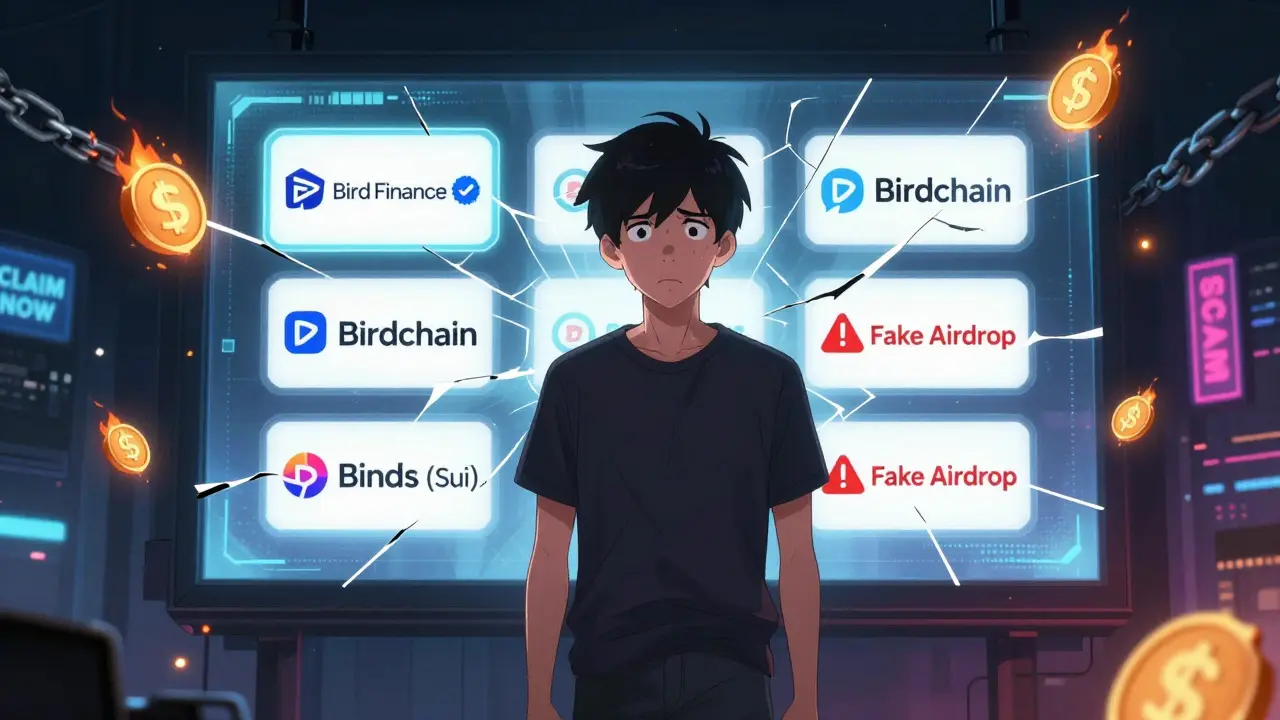

That’s not unusual in crypto-delays happen. But here’s what makes this different: multiple projects are using the name "BIRD" and running their own airdrops. You could be signing up for the wrong one.

- Birdchain is a messaging app on Solana that airdropped 1 million BIRD tokens in late 2024. You had to follow their Twitter, join their Telegram, and submit your wallet address through a bot.

- Birds is a Mini App game on the Sui blockchain. It promised BIRD tokens to players who reached level 10 and kept their Sui wallet connected. That airdrop happened in December 2024.

- There are at least three other projects with "Bird" in the name, all using BIRD as their token symbol, all running airdrops with similar rules.

So if you think you’re getting BIRD from Bird Finance, you might have accidentally signed up for a game or a messaging app. And if you sent crypto to any of these projects to "claim" your airdrop? You lost money. Real money.

How to Tell Real from Fake

Here’s how to avoid getting scammed when you hear about a BIRD airdrop:

- Check the official website. Bird Finance’s real site is bird.finance. If the link ends in .xyz, .app, or has a misspelling like "birdd.finance", it’s fake.

- Look for verified social accounts. Bird Finance’s Twitter and Telegram are linked from their official site. If you find a "BIRD airdrop" group on Telegram that wasn’t linked from bird.finance, leave it.

- Never send funds to claim. Legitimate airdrops don’t ask you to pay gas fees, buy tokens, or send crypto to unlock rewards. If they do, it’s a scam.

- Check blockchain explorers. Go to Etherscan, Solana Explorer, or HECO Scan. Search for the BIRD token contract address. If the airdrop happened, you’d see hundreds of transactions sending BIRD to wallets. As of December 2025, no such distribution exists from Bird Finance’s contract.

- Wait for an official announcement. Bird Finance has never deleted its website. If they ever launch an airdrop, it’ll be posted on their blog and pinned on Twitter. No third-party influencer or Telegram bot can override that.

Why the Confusion Exists

The problem isn’t just bad actors-it’s how crypto naming works. Tokens don’t have trademarks. Anyone can create a token called BIRD. There’s no central registry. So when Bird Finance launched, they didn’t own the name. Someone else did. And they used it.

It’s like if you started a company called "Apple Juice," and suddenly a fruit stand in California started selling "Apple Juice" too. People get confused. They buy the wrong thing. And sometimes, they get sick.

In crypto, the stakes are higher. You don’t just get bad juice-you lose your entire wallet.

What You Can Still Do

Even if the airdrop never happened, Bird Finance’s system is still active. You can still use it. Here’s how:

- Connect your wallet to bird.finance.

- Stake ETH, SOL, or HECO tokens into their smart pools.

- Let the platform auto-compound your yield.

- Receive BIRD tokens as rewards from farming-not from an airdrop, but from actual usage.

This isn’t free money. It’s earned money. And that’s the difference between a scam and a real DeFi protocol.

Some users have made decent returns by staking early and letting the deflationary model work. With 50% of supply burned and 2% of every trade redistributed to holders, BIRD’s scarcity increases over time. If adoption grows, the token could rise in value. But that’s a long-term play. Not a quick payout.

Is Bird Finance Safe?

There’s no public audit report from a major firm like CertiK or Trail of Bits. That’s a red flag. Most serious DeFi projects publish full audits. Bird Finance doesn’t. That doesn’t mean it’s hacked-it means you’re taking extra risk.

The platform uses multi-chain bridges, which are complex and prone to exploits. In 2024, cross-chain bridges lost over $1.2 billion in total due to vulnerabilities. If Bird Finance’s bridge fails, your staked assets could vanish.

Also, the DAO treasury holds 2% of every transaction. That’s a lot of tokens. Who controls it? If a few large holders dominate voting, the community doesn’t really govern anything. There’s no transparency on voting turnout or proposal history.

So is it safe? Not by traditional standards. But it’s not a scam either. It’s a high-risk, high-reward DeFi experiment. If you’re comfortable with that, use it. But never stake more than you’re willing to lose.

What’s Next for BIRD?

As of late 2025, Bird Finance hasn’t announced a new airdrop. No roadmap update. No new tokenomics change. The team is quiet. That’s not a good sign. In crypto, silence usually means either: (1) they’re building quietly, or (2) they’ve disappeared.

If you’re still interested, monitor their official channels. If a real airdrop launches, it’ll be announced with:

- A detailed blog post on bird.finance

- A pinned tweet with the token contract address

- A clear eligibility window

- No payment required

If you see any of those, you can trust it. If you don’t, walk away.

Alternatives to Bird Finance Airdrops

If you’re looking for real airdrops in late 2025, here are a few that have been verified:

- Pump.fun-distributed tokens to early creators on Solana. Over 11,000 users participated in their October 2024 campaign.

- Phantom Wallet-ran a wallet usage airdrop in Q1 2025 for users who made 10+ transactions.

- Sei Network-airdropped SEI tokens to early validators and liquidity providers in November 2024.

These projects had clear timelines, audited contracts, and public records of distributions. You can check their token balances on-chain. That’s the standard.

Bird Finance? Not yet.

Did the Bird Finance BIRD airdrop actually happen?

No, as of December 2025, there is no confirmed BIRD token distribution from Bird Finance. While early reports suggested an airdrop in late 2024 or early 2025, no blockchain transactions, official announcements, or wallet distributions have verified its execution. Many websites and social media accounts claiming to offer BIRD tokens are scams or unrelated projects.

How can I tell if a BIRD airdrop is real?

Check the official website: bird.finance. Only trust links from their verified Twitter or Telegram. Never send crypto to claim tokens. Look for the correct BIRD token contract address on Etherscan or Solana Explorer. Real airdrops don’t ask for payment. If it’s too good to be true, it is.

Why are there so many BIRD tokens?

There’s no central authority controlling the BIRD name. Multiple projects-like Birdchain, Birds (Sui Mini App), and others-have created their own tokens with the same symbol. This causes confusion. One is a DeFi platform, another is a messaging app, and another is a game. They’re not connected. Always verify the project behind the token before interacting.

Can I still earn BIRD tokens?

Yes, but not through an airdrop. You can earn BIRD by staking assets like ETH, SOL, or HECO tokens on Bird Finance’s official platform. The system automatically compounds yields and rewards you with BIRD over time. This is a yield farming opportunity, not free money.

Is Bird Finance a scam?

It’s not a confirmed scam, but it’s high-risk. There’s no public audit, no clear team identity, and no official update on the airdrop. The deflationary model is interesting, but without transparency, you’re trusting code you can’t verify. Only use it if you understand the risks and are willing to lose your stake.

What should I do if I already sent crypto to claim BIRD tokens?

Stop immediately. If you sent funds to a wallet or contract that wasn’t on bird.finance, your assets are likely lost. There’s no way to recover them. Report the scam to your wallet provider and warn others. Never use the same wallet again for airdrops unless you’ve confirmed its safety.

Joe West

December 7, 2025 AT 14:24 PMJust want to say this post is one of the clearest breakdowns of the BIRD mess I’ve seen. The part about checking blockchain explorers? Gold. I checked Etherscan myself last week and saw zero BIRD transfers from Bird Finance’s contract. Zero. If you’re waiting for an airdrop, you’re not getting one. Stop checking Telegram bots.

Noriko Robinson

December 8, 2025 AT 23:03 PMI signed up for one of those "BIRD airdrops" last year thinking it was legit. I didn’t send any crypto, just filled out a form. Still got a DM from a "support agent" asking for my seed phrase. I blocked them immediately. Never trust anyone who says "we’ll unlock your tokens if you verify your wallet."

Scott Sơn

December 9, 2025 AT 10:46 AMOh my god this is peak crypto chaos. It’s like watching 17 different people all named "Steve" show up to your birthday party and you have no idea who actually brought the cake. Bird Finance? Birdchain? Birds the Sui game? Someone please put a stop to this. I’m not even mad, I’m just disappointed. We’re all just pawns in a naming rights war where the only winner is the scammer with the prettiest Discord banner.

Stanley Wong

December 10, 2025 AT 13:15 PMIt’s funny how we all get so worked up about airdrops when the real issue is that crypto has no naming standards at all. No trademark law applies to token symbols. So if someone makes a token called BIRD and another person makes one too and they both have different contracts and different teams and different goals and one of them is a game and one of them is a yield optimizer and one of them is just a guy with a Telegram bot and a Canva design then of course people are going to get confused and send money to the wrong place and then cry about it on Reddit. The system is broken not the users.

Cristal Consulting

December 12, 2025 AT 00:28 AMGood call on the official site check. I always verify the URL before clicking anything. Bird.finance is the only one. Everything else is noise. And if you’re staking, make sure you’re on the right chain. I lost a small amount once because I connected to the wrong network. Don’t let that be you.

Tom Van bergen

December 13, 2025 AT 05:47 AMAirdrops are a scam anyway. The only people who benefit are the devs who pump the token then dump it. You think you’re getting free money but you’re just the last guy holding the bag when the rug gets pulled. This whole BIRD thing is just another version of the same old story. Wake up. There is no free lunch in crypto. Only free losses.

Sandra Lee Beagan

December 13, 2025 AT 09:00 AMAs someone who’s worked in fintech in Canada, I’ve seen this play out before. Token name collisions are rampant. It’s not just BIRD - we’ve got DAI, DAI, and DAI on three different chains with different contracts. The real danger is the emotional hook: "free money." That’s what makes people ignore red flags. The solution? Education. Not regulation. People need to learn to verify, not assume.

Ben VanDyk

December 14, 2025 AT 00:01 AMWait so the airdrop never happened and you’re telling me to just stake instead? That’s not airdrop, that’s farming. You’re just calling it airdrop because it sounds better. Why not just say "you can earn BIRD by staking" and stop pretending it’s free money? The whole thing is just marketing fluff wrapped in blockchain jargon.

michael cuevas

December 14, 2025 AT 10:08 AMBro you spent 2000 words explaining airdrop scams and the real takeaway is "don’t send crypto to strangers"? I’m impressed. Truly. Next time just post a meme of a guy handing his wallet to a clown and call it a day. Save us all the reading.

Nina Meretoile

December 15, 2025 AT 16:56 PMI love how crypto turns everything into a story. Bird Finance isn’t just a platform - it’s a metaphor. The bird that flew too close to the fire, got confused with a dozen other birds, and now everyone’s chasing shadows. But hey - if you’re staking and earning BIRD over time? That’s real. That’s growth. That’s not a lottery ticket. That’s a garden. Plant the seed. Water it. Wait. 🌱

Barb Pooley

December 16, 2025 AT 10:52 AMWho even runs Bird Finance? No team page. No LinkedIn profiles. No interviews. Just a website and a token. And now you’re telling me the airdrop never happened? I bet they’re all in a villa in Bali right now laughing at us. I’m telling you - this is a classic exit scam. They got the liquidity, burned half the supply to fake scarcity, and vanished. The silence? That’s the sound of a vault closing.

Shane Budge

December 17, 2025 AT 10:17 AMDid anyone actually get BIRD from Bird Finance? Just curious.

sonia sifflet

December 18, 2025 AT 07:49 AMYou people are so naive. If you think this is just about airdrops you don’t understand crypto at all. This is a coordinated attack to devalue real DeFi projects. The BIRD name is being poisoned so that when a real project comes along with the same name, nobody trusts it. This is psychological warfare. And you’re all just clicking links like sheep.

Adam Bosworth

December 20, 2025 AT 06:16 AMOkay but let’s be real - the entire DeFi space is a pyramid scheme with better UI. Bird Finance? More like Bird *Fiasco*. No audit? No team? Airdrop that never happened? And you still want to stake? You’re not an investor, you’re a lab rat. And I’m not even mad. I’m just impressed by how fast people forget the last 100 scams.

Uzoma Jenfrancis

December 20, 2025 AT 21:22 PMWhy do Western crypto projects always get to use names like BIRD? In Nigeria we can’t even register a token without someone from the US claiming it first. This isn’t confusion - it’s cultural theft. The name BIRD is used by our local birdwatching app too. But no one cares about that. Only the dollar matters.

Renelle Wilson

December 21, 2025 AT 07:20 AMIt’s important to recognize that while the BIRD airdrop may not have materialized, the underlying mechanism of the protocol - yield optimization through automated compounding and deflationary redistribution - is still technically sound. The absence of an airdrop does not invalidate the functionality of the platform. Users who engage with it as a yield-generating tool, rather than a speculative lottery, are operating with a more sustainable mindset. The real risk lies not in the protocol, but in the misalignment of expectations. When users conflate participation with entitlement, they become vulnerable to exploitation. The solution is not more regulation, but more education - and perhaps, a cultural shift away from the myth of the instant airdrop windfall.

Elizabeth Miranda

December 22, 2025 AT 10:53 AMMy friend got scammed by a fake BIRD airdrop last year. Sent $800 in ETH to claim tokens. Never heard back. She still checks her wallet every day like it’s going to magically appear. I told her to just move on. But she says she’s "waiting for justice." Crypto breaks people in quiet ways.

Chloe Hayslett

December 23, 2025 AT 23:52 PMOh wow. A 2000-word essay on why you didn’t get free money. Congrats. You saved someone from a scam they probably wouldn’t have fallen for anyway. Meanwhile, the real scam is spending your life writing this instead of just saying "don’t send crypto to strangers" and moving on.