Singapore Crypto Exchange License Calculator

Calculate Your Requirements

License Type

Minimum Capital Required

Estimated Application Timeline

Key Requirements

Before June 30, 2025, some crypto exchanges could operate from Singapore while serving only overseas customers - no local license needed. That loophole is gone. Now, if you're running a crypto exchange out of Singapore, even if your users are in Brazil, Nigeria, or Canada, you must be licensed by the Monetary Authority of Singapore (MAS). There are no exceptions. No gray areas. No grace periods. If you’re not licensed, you’re shut down.

Why Singapore Changed the Rules

Singapore didn’t make this move because it hates crypto. It’s the opposite. The city-state wants to be a global hub for digital assets - but only if it’s done right. The collapse of Three Arrows Capital in 2022 and the TerraUSD crash that same year shook confidence. These weren’t local failures; they were global disasters that traced back to Singapore-based entities operating without oversight. MAS saw it clearly: a crypto firm based in Singapore, serving foreign clients, but ignoring local rules, was a threat to the country’s financial reputation. The new Financial Services and Markets Act (FSMA), effective June 30, 2025, closed that door. Now, every Digital Token Service Provider (DTSP) - whether it’s a small exchange or a giant platform - must be licensed. No more hiding behind offshore clients. If you’re physically in Singapore, you play by Singapore’s rules.Two License Types: Standard and Major Payment Institution

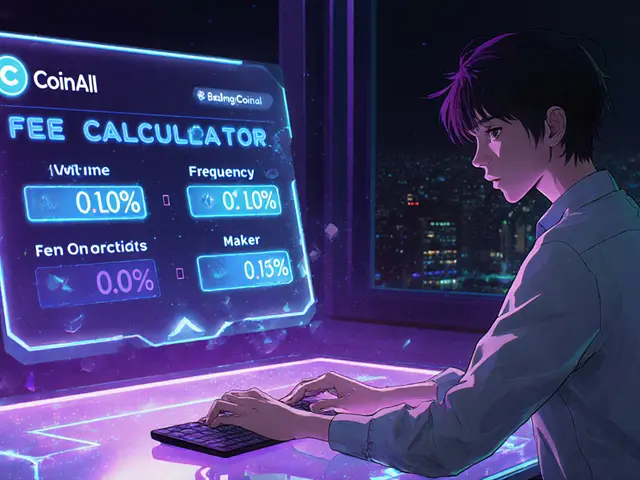

Under the Payment Services Act 2019 (PSA), which still applies alongside FSMA, there are two main licenses for crypto exchanges:- Standard Payment Institution License: For businesses processing up to SGD 3 million in monthly transaction volume. Requires a minimum capital of SGD 100,000. This is the entry point for smaller exchanges or those testing the market.

- Major Payment Institution License: For operators exceeding SGD 3 million monthly. Requires SGD 250,000 in minimum capital. This comes with stricter controls: deeper audits, enhanced risk management, and continuous monitoring.

What the License Actually Requires

Getting licensed isn’t about filling out a form. It’s about proving you can run a secure, transparent, and compliant business. Here’s what MAS demands:- Full KYC and AML Procedures: Every user must be verified. Not just ID checks - you need proof of address, source of funds, and ongoing transaction monitoring. MAS Notice PSN02 sets the standard. It’s the same bar as banks.

- Written Policies: You need detailed documents covering how you handle customer funds, process trades, detect fraud, and respond to suspicious activity. These aren’t suggestions. They’re mandatory.

- Risk Assessments: You must identify every possible threat - from hacking to money laundering to insider fraud - and show how you’ll stop it. This includes cybersecurity plans, cold storage protocols, and insurance coverage.

- Annual Audits: Both internal and external audits are required. External auditors must be approved by MAS and report directly to them.

- Capital Proof: You must show you have the money. Not just on paper - bank statements, financial guarantees, or verified funding sources. MAS checks this.

How Long Does It Take?

There’s no quick path. The timeline depends on your size and how prepared you are.- Standard License: 3 to 6 months with a good compliance team.

- Major License: 6 to 12 months. MAS digs deeper. They’ll ask for more, check again, and request revisions.

How Singapore Compares to Other Countries

Singapore’s approach sits between two extremes. China banned crypto exchanges outright. Some offshore islands like the Cayman Islands have almost no rules. Singapore chose a middle path: strict but fair. Compare it to the EU’s MiCA regulation - it gives firms years to adapt. Singapore gave zero. Compare it to the U.S. - where each state has different rules and the SEC is unpredictable. Singapore offers one clear national standard. Switzerland requires millions in capital for similar licenses. Singapore’s SGD 100,000-250,000 range is much more accessible for mid-sized players. That’s intentional. MAS wants serious operators, not fly-by-night shops.Who’s Struggling? Who’s Thriving?

Smaller exchanges are feeling the heat. Many didn’t have compliance teams. They relied on offshore clients to avoid regulation. Now, they’re out of business. Some moved operations to Dubai or Malaysia. Others shut down entirely. Larger exchanges - like those backed by venture capital or with existing financial infrastructure - welcomed the clarity. They can afford the lawyers, the auditors, the systems. For them, licensing isn’t a cost - it’s a competitive advantage. It signals trust. Reddit threads and crypto forums are full of complaints. Users report applications taking over a year. One exchange owner said, “We spent 11 months and three lawyers just to get our AML policy approved.” But institutional investors? They’re excited. They now know that a Singapore-licensed exchange has real oversight. That’s rare in crypto.What Happens If You Don’t Apply?

MAS doesn’t warn twice. If you’re operating without a license after June 30, 2025, you’re breaking the law. Penalties include:- Fines up to SGD 1 million

- Imprisonment for executives

- Asset freezes

- Public blacklisting

The Future: More Rules, Not Less

MAS has said it clearly: “We will generally not issue a license for operations serving only overseas clients.” That’s a warning to offshore-focused exchanges. Even if you think you’re not targeting Singapore, if you’re based here, you’re in scope. Expect more rules soon. MAS is already looking at:- Stablecoin reserve transparency

- Real-time transaction reporting

- Minimum cybersecurity standards

- Disclosure requirements for token listings

What Should You Do Now?

If you’re running a crypto exchange in Singapore:- Stop assuming you’re exempt because your users are overseas.

- Review your transaction volume. Are you over SGD 3 million/month? Then you need a Major License.

- Hire a Singapore-based compliance consultant with crypto experience. Don’t try to do this alone.

- Start gathering documents: KYC policies, risk assessments, capital proof, audit reports.

- Apply now. Even if you think you’re ready, the process takes months.

- Don’t base it in Singapore unless you’re ready to meet the standards.

- Consider if you can afford the capital, the legal fees, and the ongoing compliance costs.

- Ask yourself: Is this worth it? Because once you’re licensed, you’re locked in - no turning back.

Frequently Asked Questions

Do I need a license if my crypto exchange only serves foreign customers?

Yes. Under the FSMA that took effect on June 30, 2025, any crypto exchange operating from Singapore - regardless of where its users are located - must be licensed by MAS. The previous loophole that allowed offshore-only operations is closed. If your company is registered or has a physical presence in Singapore, you’re subject to the same licensing rules as domestic exchanges.

How much does it cost to get a crypto exchange license in Singapore?

The minimum capital requirement is SGD 100,000 for a Standard Payment Institution License and SGD 250,000 for a Major Payment Institution License. But the total cost is much higher. Legal fees, compliance consultants, audit reports, software systems, and staffing can easily push total expenses to SGD 200,000-500,000. Ongoing compliance costs - including annual audits and monitoring tools - add another SGD 50,000-100,000 per year.

How long does the license application process take?

For a Standard License, expect 3 to 6 months with professional help. For a Major License, it’s typically 6 to 12 months. MAS conducts deep due diligence, requests multiple revisions, and may require additional documentation. Many applicants face delays because their initial submissions lack detail or don’t meet MAS’s strict formatting and policy standards.

Can I apply for a license if I’m not based in Singapore?

No. To apply for a DTSP license, your company must have a legal presence in Singapore - either a registered company or a branch office with a local director. MAS requires physical operations and local management. You can’t apply from overseas, even if you have Singaporean clients.

What happens if my license application is rejected?

You can reapply after addressing MAS’s feedback, but there’s no guarantee of approval. Repeated failures can trigger a review of your business’s overall credibility. MAS may also publicly note your application status if they suspect intentional non-compliance. Many firms that are rejected are forced to shut down or relocate operations outside Singapore.

Are there any alternatives to getting a Singapore license?

Yes - but they’re not easy. You can relocate your company’s legal base to a jurisdiction with lighter regulation, like Dubai, Malta, or Hong Kong. However, if you keep any operations, staff, or servers in Singapore, you’re still subject to MAS rules. You can’t outsource compliance by moving your office - MAS looks at where you operate, not just where you’re registered.

Reggie Herbert

December 5, 2025 AT 19:32 PMThe MAS isn't just regulating crypto - they're engineering a financial monoculture. If you're not playing by their rigid, bank-grade compliance playbook, you're not welcome. This isn't innovation - it's institutional capture disguised as protection. Real decentralization doesn't need a government stamp of approval. If you're building something genuinely peer-to-peer, Singapore is the last place you want to be.

Murray Dejarnette

December 7, 2025 AT 03:03 AMBro. I just got rejected for my Standard License application. Spent $80k on lawyers, got a 3-page email back saying my AML policy was 'insufficiently granular.' I'm not even mad. I'm just done. I'm moving my servers to Dubai. At least there, they care if you're good - not if your paperwork has the right font size. 😤

Sarah Locke

December 7, 2025 AT 14:20 PMHey everyone - I know this feels overwhelming, but listen: this is actually a HUGE opportunity. 🌟 Yes, the rules are tough. But think about it - if you get licensed, you're not just compliant. You're *trusted*. Institutional money is finally flowing into crypto because places like Singapore are making it safe. You’re not just surviving regulation - you’re leading the next wave of real finance. I believe in you. You got this. 💪

Mani Kumar

December 9, 2025 AT 10:04 AMSGD 100,000 capital requirement is negligible for any serious operator. The real barrier is operational discipline. Most applicants fail because they confuse paperwork with compliance. MAS expects systemic integrity - not bullet points. If you think this is expensive, wait until your exchange gets frozen and your executives are subpoenaed.

Tatiana Rodriguez

December 11, 2025 AT 02:07 AMI just spent six months trying to get this license for my little exchange, and honestly? I cried when they approved it. 🥹 I mean, the audits, the forms, the endless revisions - it felt like climbing Mount Everest in flip-flops. But then I got the email - 'License Granted' - and I just sat there staring at my screen. My grandma, who’s never used crypto, called me to say she finally feels safe investing. That’s the power of trust. This isn’t bureaucracy - it’s a lifeline for real people. I’m so proud we stuck with it.

Philip Mirchin

December 12, 2025 AT 20:56 PMLook, I’m from the U.S. - we got 50 different state regulators and the SEC playing whack-a-mole with every new token. Singapore’s approach? Clear, unified, and actually enforceable. Yeah, it’s strict. But at least you know where you stand. No more guessing if the next tweet from Gary Gensler is gonna shut you down. If you’re serious about crypto, this is the gold standard. And honestly? We need more of this.

Britney Power

December 13, 2025 AT 13:10 PMThe MAS is not 'protecting investors' - they're protecting the Singaporean financial elite's monopoly. This licensing regime is a velvet-glove cartel. The $500,000+ cost of compliance effectively eliminates small players, consolidating the market into the hands of VCs and legacy banks. What's next? Mandatory background checks for users? Mandatory use of MAS-approved custody providers? This isn't regulation - it's financial fascism dressed in a suit. And don't let the 'trust' rhetoric fool you - it's control, pure and simple.

Maggie Harrison

December 14, 2025 AT 00:35 AMCan we just take a second to appreciate how wild this is? 🤯 Crypto was supposed to be the rebellion against banks, right? And now, the most respected crypto hub in Asia is demanding KYC stricter than your bank, audits like a Fortune 500, and capital requirements that make startups weep. But… I kinda love it. 🙌 It’s like crypto finally grew up. No more rug pulls. No more shady offshore shells. Just clean, regulated, real business. The future isn’t anonymous - it’s accountable. And honestly? I’m here for it. 💙

Lawal Ayomide

December 14, 2025 AT 15:08 PMI run a small exchange from Lagos. We served African users only. Now we’re shutting down. No license. No way to comply. MAS says ‘if you’re based in Singapore’ - but what if your server is in Singapore but your team is in Nigeria? Who decides? This isn’t fair. It’s a global system. Why should one country’s rules kill businesses elsewhere?

justin allen

December 15, 2025 AT 17:05 PMLet me get this straight - Singapore, a tiny island with no natural resources, thinks it can dictate global crypto rules? LOL. The U.S. has 330 million people. China has 1.4 billion. And Singapore? 5.6 million. Who gave them the right to be the crypto police? This isn't leadership - it's arrogance wrapped in a corporate policy document. The world doesn't bow to Singapore. We're moving on.

ashi chopra

December 16, 2025 AT 13:09 PMI just wanted to say thank you to everyone who shared their stories here. It’s easy to get lost in the numbers and regulations, but behind every license application is a person trying to build something real. To the ones who got rejected - you’re not failures. You’re pioneers. And to the ones who made it - you’ve earned your place. This isn’t just about compliance. It’s about integrity. And that matters more than any token price.

Darlene Johnson

December 16, 2025 AT 21:43 PMThey’re not just licensing exchanges. They’re building a surveillance state. Every transaction monitored. Every user tracked. Every wallet linked to an ID. This isn’t about safety - it’s about control. And once they have your data, they’ll use it. Mark my words: next year, they’ll require biometric login. Then, geo-fencing. Then, algorithmic trading bans. This is the first step. The crypto freedom movement is being dismantled, one regulatory form at a time. Wake up.