Bird Finance DeFi: What It Is, Why It Matters, and What You Should Know

When you hear Bird Finance DeFi, a decentralized finance protocol built on Binance Smart Chain that offers yield farming and token rewards. Also known as Bird Finance, it's one of many small DeFi projects trying to attract users with high APYs and token incentives. But here’s the thing—most of these projects don’t last. Bird Finance DeFi isn’t a household name like Uniswap or Aave. It doesn’t have a big team, public audits, or institutional backing. It’s a lean, community-driven experiment built on the same chain as hundreds of other tokens that rose fast and vanished faster.

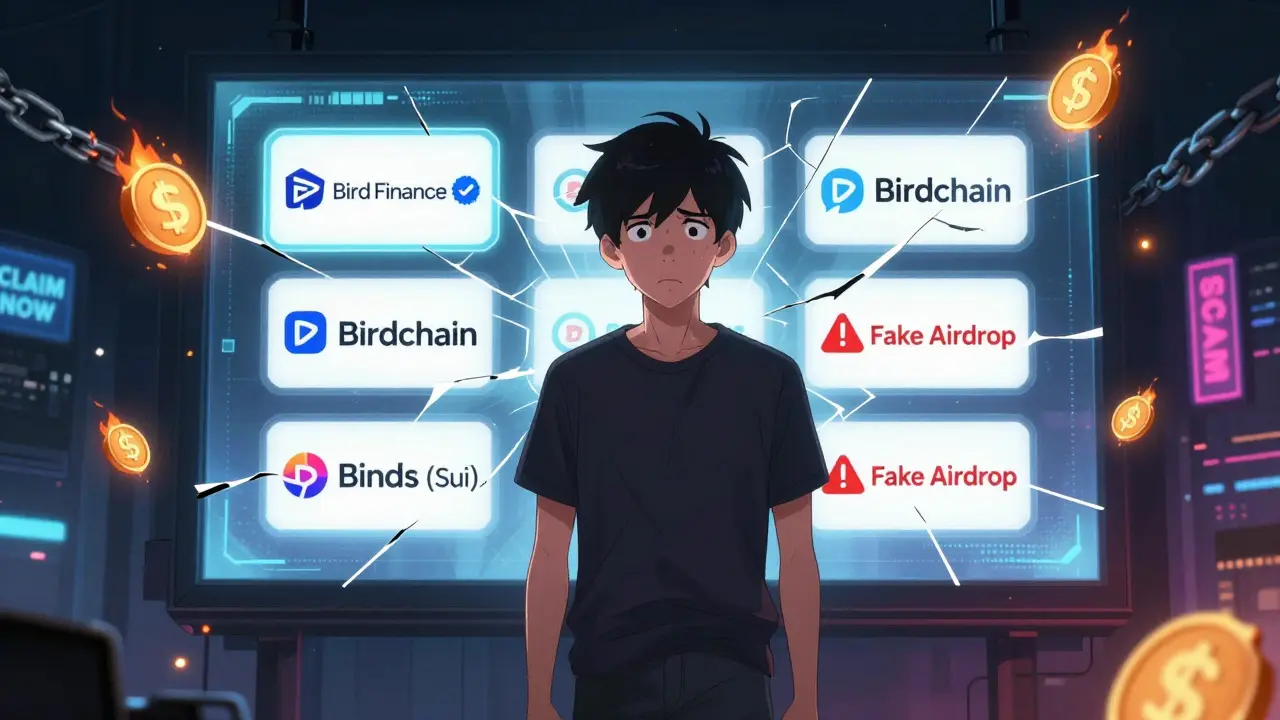

DeFi protocols like Bird Finance DeFi rely on yield farming, the practice of locking up crypto tokens in smart contracts to earn rewards. Also known as liquidity mining, this is how users make money without selling their assets. But rewards aren’t free. They’re paid out in new tokens, often with no real value behind them. If the token price drops, your rewards become worthless. And if the project gets abandoned—or worse, the devs rug pull—you lose everything. That’s why you see so many posts about dead tokens like Ageio Stagnum, Shibnobi, and Shiro Pet. Bird Finance DeFi sits right in that same risky space. It’s not a scam by default, but it’s not safe either. You’re betting on a small team, a weak community, and a token that could vanish overnight.

Most of the projects linked to Bird Finance DeFi operate on Binance Smart Chain, a blockchain optimized for low-cost transactions and DeFi applications. Also known as BSC, it’s popular because it’s cheap and fast—but also because it attracts low-quality projects that can’t afford Ethereum’s fees. That’s why you’ll find so many airdrop scams, fake NFT rewards, and zero-volume tokens on BSC. Bird Finance DeFi isn’t unique in that. It’s part of a pattern. The same chain that powers PancakeSwap also powers hundreds of ghost tokens. The difference? One is widely used. The others? They’re just noise.

What you’ll find in the posts below isn’t a glowing review or a tutorial on how to farm Bird Finance DeFi tokens. It’s the truth. You’ll see how similar projects collapsed, how users got burned, and why even a small DeFi protocol can disappear without a trace. You’ll learn what to look for before you stake your crypto, and what red flags mean it’s time to walk away. There’s no magic here. Just cold, hard facts about a space where hype moves faster than value.

Bird Finance BIRD Airdrop: What Actually Happened and How to Verify Legitimacy

The Bird Finance BIRD airdrop never officially happened. Despite rumors and fake claims, no tokens were distributed. Learn how to spot scams, verify real opportunities, and earn BIRD tokens through legitimate DeFi staking instead.