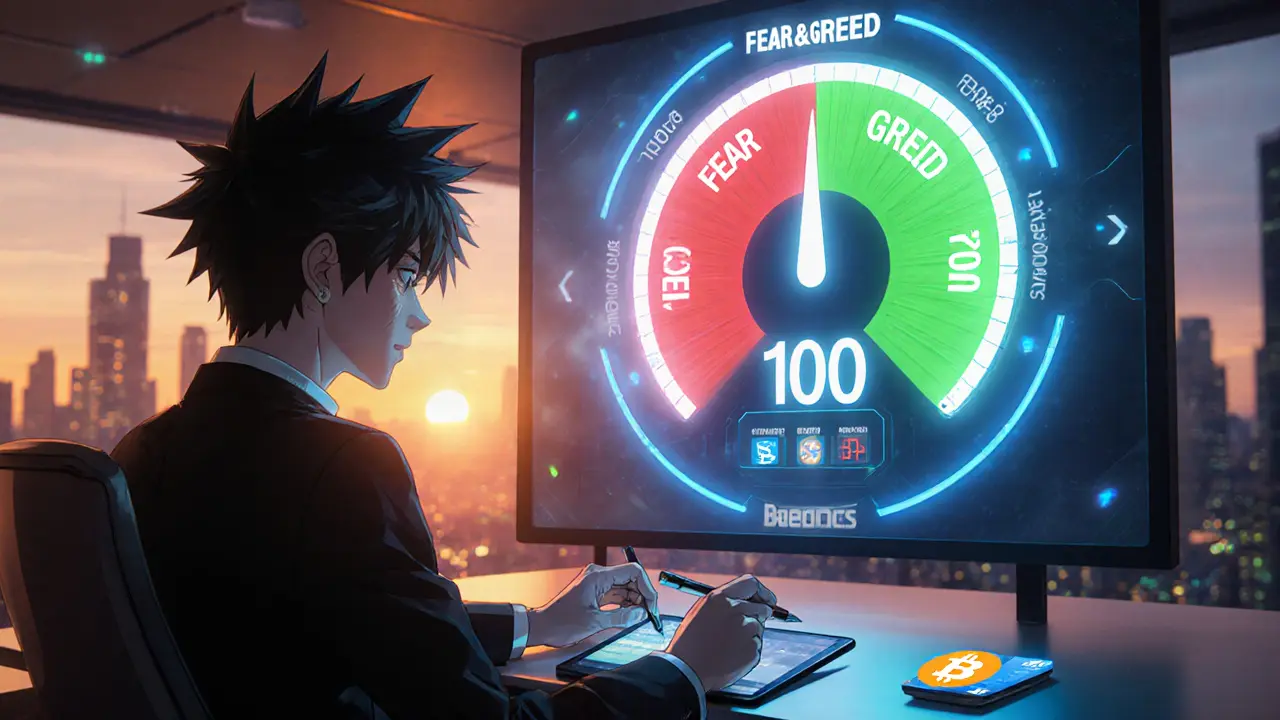

Fear and Greed Index

When you hear about the Fear and Greed Index, a numeric gauge that rates market mood from extreme fear to extreme greed, most traders instantly picture a color‑coded meter flashing green or red. Also known as the sentiment meter, it translates collective investor emotions into a single figure that can be tracked daily. This index falls under the broader concept of Market sentiment, the overall attitude of investors toward a particular market or asset class, which drives buying pressure and selling panic alike. Because sentiment is a key driver of price swings, the index is a staple in Technical analysis, the study of past market data to forecast future moves. It also mirrors the Volatility, the rate at which an asset’s price fluctuates that crypto fans chase, especially for flagship coins like Bitcoin, the first and largest cryptocurrency by market cap.

Fear and Greed Index isn’t just a number you glance at before coffee; it’s a decision‑making tool. When the reading slides into “Extreme Fear,” historically it signals a potential buying opportunity, especially for assets that have been hammered by negative news or regulatory scares. Conversely, “Extreme Greed” often precedes pullbacks, prompting seasoned traders to tighten stops or hedge positions. The index ties directly to market sentiment, which in turn influences Bitcoin price movements and altcoin rallies. Many of our articles—like the deep dive on restaking or the review of high‑risk exchanges—reference these sentiment shifts to explain why a coin’s risk profile spikes at certain times.

What the Index Reveals for Crypto Traders

Using the index effectively means pairing it with other technical indicators. A common setup is to watch the index cross the 50‑point threshold while the 14‑day RSI shows overbought conditions. If the Fear and Greed reading is high and the RSI signals overbought, that double signal often precedes a correction. On the flip side, a low index combined with a bullish moving‑average crossover can hint at an upcoming rally. Volatility, captured by the VIX for traditional markets, finds its crypto counterpart in the index’s rapid swings; spikes in the index usually accompany spikes in Bitcoin’s 24‑hour price range. Behavioral finance researchers argue that collective emotions—fear, greed, hope—create self‑fulfilling cycles, and the index makes those cycles visible.

While the index offers valuable insight, it isn’t a crystal ball. Major regulatory announcements, exchange hacks, or macro‑economic shifts can flip sentiment in minutes, making it essential to stay updated with news feeds and on‑chain data. Our collection below dives into real‑world examples: from how a sudden “fear” spike affected BiorLabs tokenomics to why the CHAOEX exchange was flagged as high‑risk during a period of extreme greed. By understanding how the Fear and Greed Index interacts with market sentiment, technical analysis, volatility, and Bitcoin’s price dynamics, you’ll be better equipped to read the market’s next move. Below you’ll find a curated set of articles that illustrate these concepts in action.

Fear and Greed Index Explained: How Market Sentiment Impacts Stocks & Crypto

Learn how the Fear and Greed Index works, its seven components, stock vs. crypto versions, and practical ways to use it for better investment decisions.